The early august sell-off was, it turns out, remarkably brief. And while it is now behind us, we think it is useful to take some messages from that for adjusting investor positioning.

Going into that sell-off it wasn’t the valuation of the market that was necessarily odd, it was more the juxtaposition of that with low volatility that seemed strange. High valuations do not necessarily beget a sell-off but they DO increase the likelihood of volatility being higher as there is greater sensitivity to any weak newsflow.

We expect the equity market to end the year slightly higher but with volatility remaining elevated. So it would be a mistake, we think, to interpret that episode as a reason to be bearish. But we do think there is a case for add some diversifiers to offset higher volatility.

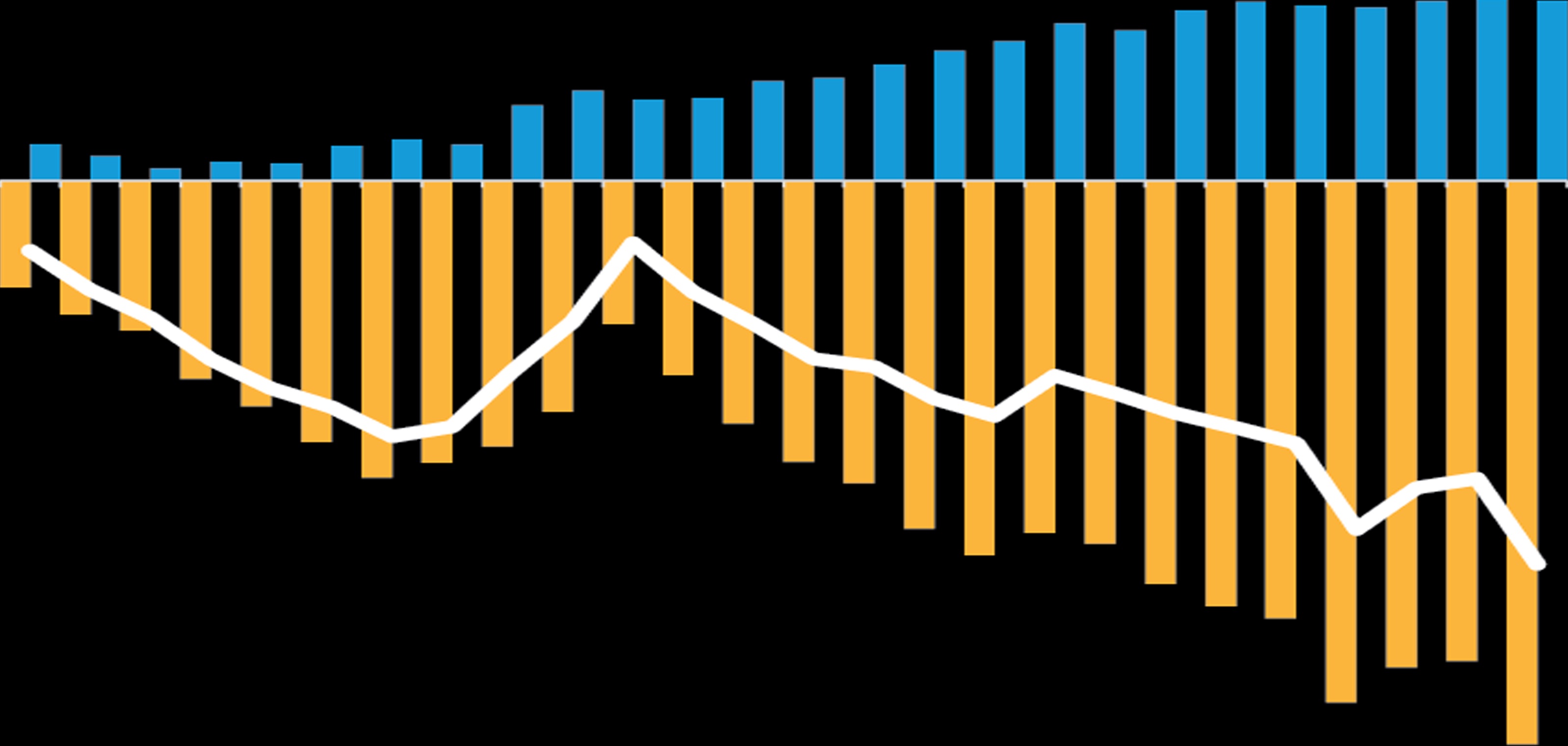

There has been a definitive slow-down in growth. Our own indicator for year-ahead EPS growth in the US has fallen from 12% to 8% in the space of two months. Likewise, US employment data has been meaningfully weaker. But all of this is more consistent, we think, with the US economy having a soft landing rather than an outright recession.

There is a potential fly in the ointment. This is the news from some prominent US consumer-facing companies that say they are facing a slowing in demand which they expect to persist into next year. This needs to be watched. Also, as many investors point out to us, the yield curve remains inverted. But that has failed in its ability to forecast a recession for two years, so we don’t put too much weight on that.

The other topic that has come up a lot in discussion with investors is the prognosis for inflation. A disinflationary path has become clear - in step with slowing macro data. But we think it is important not to confound CYCLICAL and STRUCTURAL inflation. From a strategic perspective we still expect forces such as deglobalization and high public debt to lead to higher equilibrium inflation. This still needs to be reflected in strategic asset allocation with a higher exposure to real assets.

In conclusion, we think it would be a mistake to interpret the events of early August as a reason to be overly defensive, and think the market can end the year somewhat higher - albeit with small upside and more volatility. We do think that investors could consider trades that might diversify returns. From a factor perspective we think low vol is one such attractive allocation.

From a regional perspective, we used the recent sell-off in Japan to increase exposure there, reflecting a 25% discount to global equities. Likewise, we also recently became more positive on the UK given the scale of investor outflows and lack of crowding.

From a sector perspective the global Energy sector looks attractive given a high degree of net buybacks, above-market FCF and recent investor outflows.

Thank you for your time.

Deleveraging or Heralding a Recession?

06 September 2024

3 min watch

About the Authors

Inigo Fraser Jenkins is Co-Head of Institutional Solutions at AB. He was previously head of Global Quantitative Strategy at Bernstein Research. Prior to joining Bernstein in 2015, Fraser Jenkins headed Nomura's Global Quantitative Strategy and European Equity Strategy teams after holding the position of European quantitative strategist at Lehman Brothers. He began his career at the Bank of England. Fraser Jenkins holds a BSc in physics from Imperial College London, an MSc in history and philosophy of science from the London School of Economics and Political Science, and an MSc in finance from Imperial College London. Location: London