But the revised forecast also implies a flatter trajectory and a modest growth downgrade for 2021—from a gain of 3.8% to 3.4%, so the overall economic activity level at the end of 2021 doesn’t change meaningfully with this forecast update. In our assessment, it will take until the fourth quarter of 2021 or first quarter of 2022 before US economic activity regains its previous peak.

Recovery Progress Rests on Critical Assumptions

As always, economic forecasts require underlying assumptions, and in this case those assumptions have little to do with economics. Instead, they have a lot to do with developments in the public health sphere, political policies and the resulting outcomes:

- Fiscal policy is a significant driver of our growth outlook, and our assumption is that the US Congress and executive branch will eventually wrestle a stimulus bill into shape that will support 2021 economic growth.

- We’re also assuming that the country isn’t forced to renew a broad national lockdown to control the spread of COVID-19. Likewise, we’re assuming that we won’t see a surprise near-term medical innovation that could be a game changer, fundamentally altering the macro picture in the next couple of quarters for the better.

- Whether it’s through medical advances or society and the economy adapting to a world where COVID-19 is a regular presence, we’re basing our outlook on the virus no longer being the dominant macro story by the second half of 2021.

- While we’re not assuming a specific outcome to the US elections, we are assuming that it’s not disruptive in the medium term—that society will continue to function even if the election outcome is disputed for some time.

Good News: A Better Third-Quarter Rebound

The US economy bounced back more robustly in the third quarter than we had anticipated, which warranted the upgraded 2020 GDP growth forecast. Personal consumption was the big driver: with fiscal support playing a key role, household spending held up better than expected.

The strength certainly isn’t uniform, though. Consumption of goods has fully rebounded, but consumption of services remains deeply distressed. Housing activity is robust, but industrial production has lagged. Still, in aggregate, the third quarter was encouraging.

2021: More Fiscal Support Remains Vital

The downgrade to the 2021 GDP forecast largely relates to questions about additional fiscal support—still a critical need despite the strong third quarter.

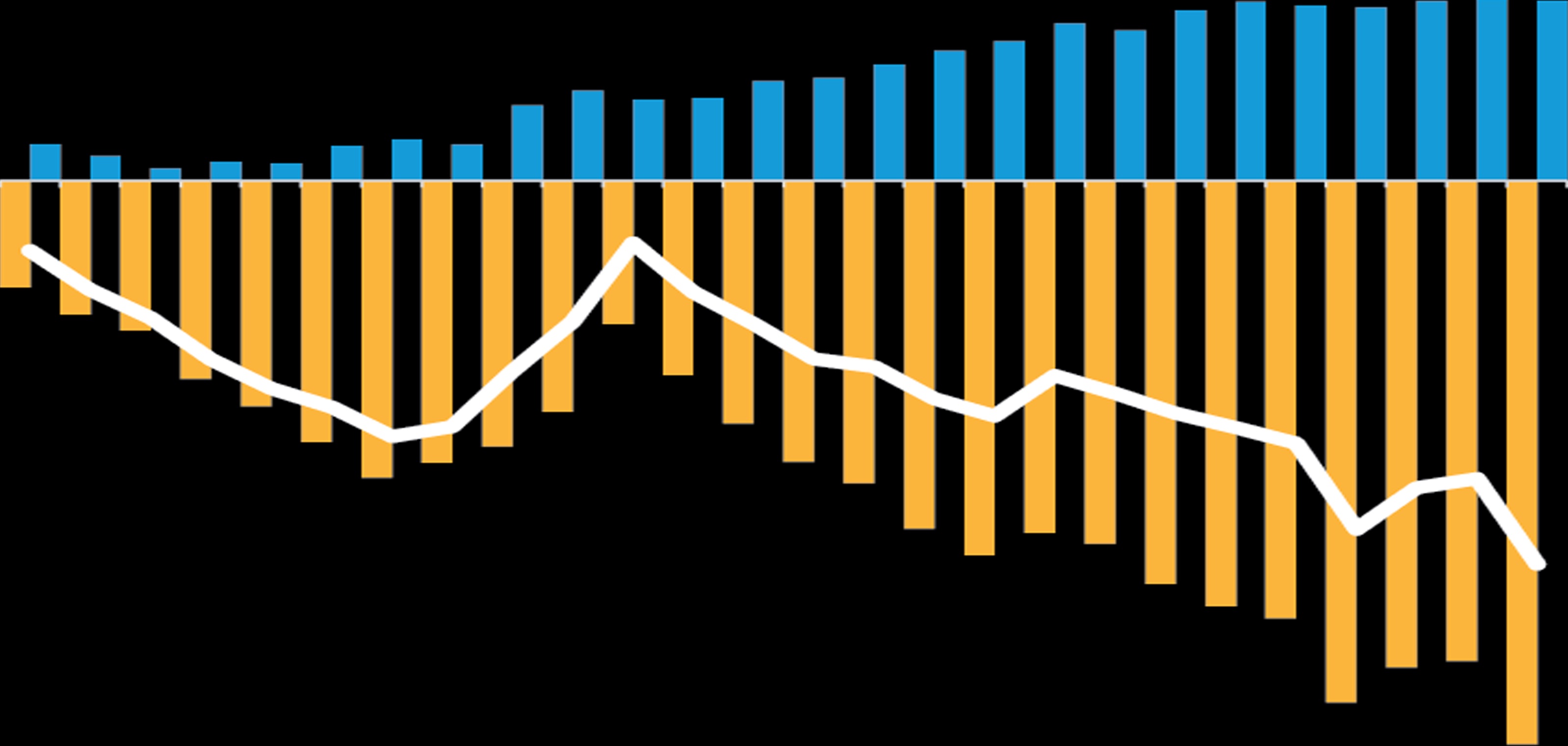

More than 10 million people employed prior to COVID-19 remain out of work today. Economic activity may be roughly two-thirds of the way back, but the labor market is only halfway back. That’s a particular concern given the rising share of job losses now deemed permanent. So far, households have gotten by thanks to fiscal support programs, which have shored up income for those who lost their jobs.

But those programs have largely expired, leaving many households at risk of taking a huge step back. If labor gains continue at the pace seen in September, it will take almost 18 months for the US economy to return to full employment, so there’s still a large gap to fill (Display). That makes fiscal policy critical as a bridge for household incomes during the gradual expansion to come.