-

The value of an investment can go down as well as up and investors may not get back the full amount they invested. Before making an investment, investors should consult their financial advisor.

Market Sell-Off Shows Risk Is a Moving Target

As of September 30, 2018

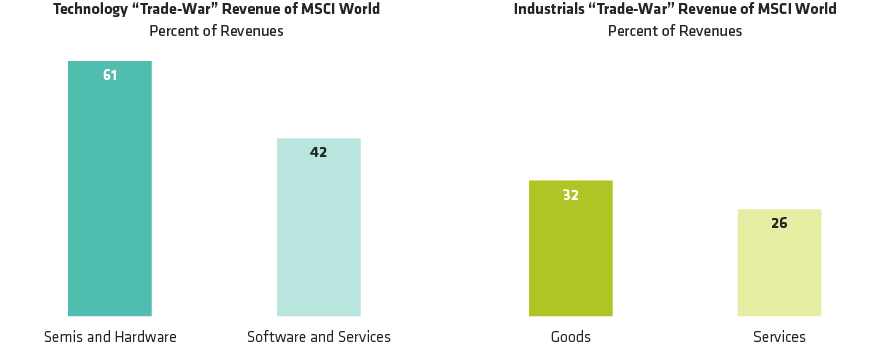

“Trade-war” revenue for US stocks is non-US revenue, and for non-US stocks is US revenue.

Source: FactSet, MSCI and AllianceBernstein (AB)

Past performance and current analysis do not guarantee future results.

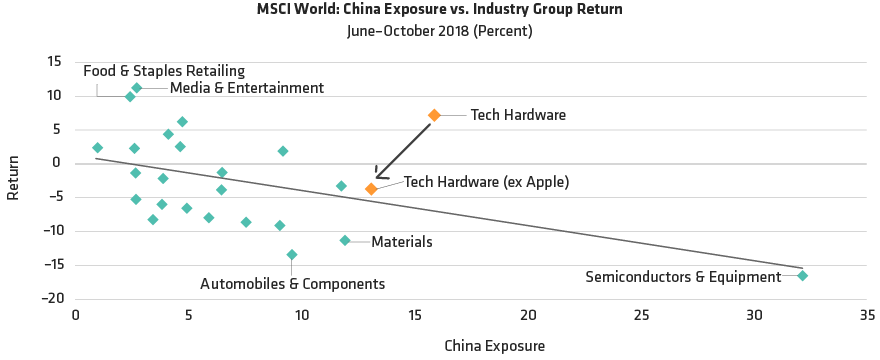

Industry exposure is based on a weighted average as of May 31, 2018.

Returns shown in US-dollar terms from June 1, 2018 through October 31, 2018.

Source: FactSet, MSCI and AllianceBernstein (AB)

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

Kent Hargis is the Chief Investment Officer of Strategic Core Equities. He created the Strategic Core platform and has been managing the Global, International and US Strategic Core portfolios since their inception in 2011. Hargis has also been Portfolio Manager for the Global Low Carbon Strategy Portfolio since 2022. Previously, he managed the Emerging Portfolio from 2015 through 2023. Hargis was global head of quantitative research for Equities from 2009 through 2014, with responsibility for directing research and the application of risk and return models across the firm’s equity portfolios. He joined AB in 2003 as a senior quantitative strategist. Prior to that, Hargis was chief portfolio strategist for global emerging markets at Goldman Sachs. From 1995 through 1998, he was assistant professor of international finance in the graduate program at the University of South Carolina, where he published extensively on various international investment topics. Hargis holds a PhD in economics from the University of Illinois, where his research focused on international finance, econometrics and emerging financial markets. Location: New York

Sammy Suzuki is Head of Emerging Markets Equities, responsible for overseeing AB’s emerging-markets equity business and instrumental in the formation and shaping of AB’s Emerging Markets Equity platform. He was also a key architect of the Strategic Core platform and has managed the Emerging Markets Portfolio since its inception in 2012, and the Global, International and US portfolios from 2015 to 2023. Suzuki has managed portfolios since 2004. From 2010 to 2012, he also held the role of director of Fundamental Value Research, where he managed 50 fundamental analysts globally. Prior to managing portfolios, Suzuki spent a decade as a research analyst. He joined AB in 1994 as a research associate, first covering the capital equipment industry, followed by the technology and global automotive industries. Before joining the firm, Suzuki was a consultant at Bain & Company. He holds both a BSE (magna cum laude) in materials engineering from the School of Engineering and Applied Science, and a BS (magna cum laude) in finance from the Wharton School at the University of Pennsylvania. Suzuki is a CFA charterholder and was previously a member of the Board of the CFA Society New York. He currently serves on the Board of the Association of Asian American Investment Managers. Location: New York

Christopher W. Marx is Senior Vice President and Global Head of Equity Business Development. He is responsible for overseeing the firm's team of equity investment strategists and product managers, setting strategic priorities and goals for the global Equities business, developing new products, and engaging with clients to represent market views and investment strategies of the firm. Previously, Marx was a senior investment strategist and a portfolio manager of Equities, and in 2011 he cofounded the Global, International and US Strategic Core Equity portfolios with Kent Hargis. He joined the firm in 1997 as a research analyst covering a variety of industries both domestically and internationally, including chemicals, metals, retail and consumer staples. Marx became part of the portfolio-management team in 2004. Prior to joining the firm, he spent six years as a consultant for Deloitte & Touche and Boston Consulting Group. Marx holds a BA in economics from Harvard University and an MBA from the Stanford Graduate School of Business. Location: New York