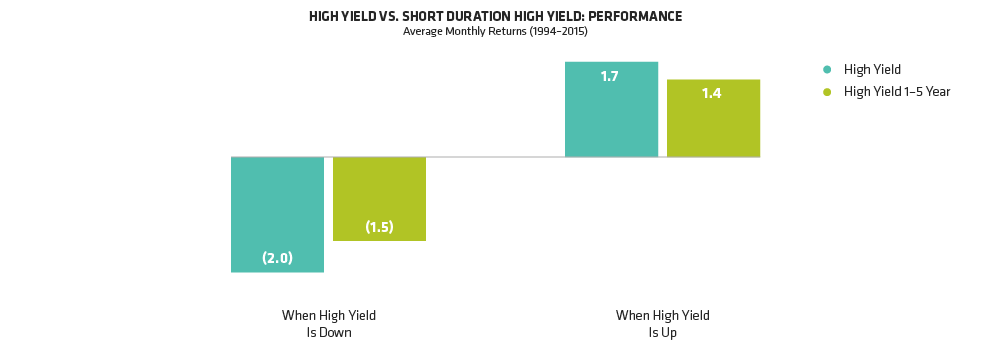

Why does this combination work so well? First, shorter maturities mean investors are less exposed to rising interest rates and just about any type of unexpected market hiccup. So they tend to hold up better in down markets.

It’s a similar story with credit quality. Higher-rated securities from companies with strong balance sheets can weather a period of higher borrowing costs and investment outflows better than the issuers of CCC-rated “junk” bonds.

That’s easy to forget when markets are booming. The broad US high-yield market is up more than 16% this year, and CCCs have been top performers; the more CCCs investors bought, the better they did.

But this is not a viable long-term strategy, particularly at this late stage of the credit cycle. Even if the new policies do unleash faster growth, the inevitable rise in interest rates could push some CCC-rated issuers toward default.

Reaching Beyond Corporates

There’s income to be had beyond high-yield corporates, of course. That’s why a global, multi-sector approach is so important. The most effective high-income strategies seek diversification by drawing on multiple sources of income from around the world.

Among them are emerging-market local-currency bonds. While high-yield corporates extended the year’s rally after the US election results, these assets sold off sharply for fear of higher US interest rates and Trump’s protectionist trade policies.

That left valuations attractive in many cases—especially on assets from countries that have been cracking down on corruption and embracing tighter fiscal policies.

Another potential income generator—and diversifier: US securitized assets, particularly credit risk transfer securities (CRTs) from US government housing agencies Fannie Mae and Freddie Mac. These allow investors to tap into a strong US housing market, and their floating rates make them appealing in a rising rate environment. Unlike typical agency debt, they have credit risk. But investors are compensated handsomely for it with high yields.

Recalibrating an investment strategy—even if only slightly—is always a good idea; we should all do it periodically throughout the year, not just in January. But with all the uncertainties facing investors now, it seems like a no-brainer this year.

By all means, we think investors should continue to lean toward high-yielding assets in 2017. But selectivity and diversification are critically important. This isn’t the time to limit yourself to a single sector or region.