-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

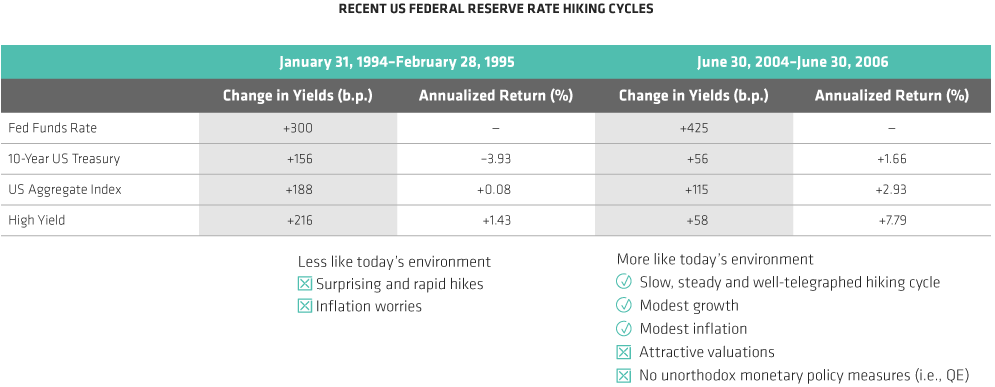

Fearing Rising Rates? History Doesn’t Always Repeat

19 September 2017

1 min read

Not All Periods of Rising Rates Look Alike

Past performance and current analyses do not guarantee future results. Any benchmark or index cited herein is for comparison purposes only. An investor generally cannot invest in an index. The unmanaged index does not reflect fees and expenses associated with the active management of an AB portfolio.

As of September 15, 2017

The time periods shown above are as of a month-end prior to the official rate hike and through a month-end following the last increase in official rates.

Source: Barclays Bloomberg and AB