Enter tax reform. Congressional Republicans’ comprehensive tax rewrite contains several key elements that will affect the US corporate bond market. These include capping the deductibility of interest, a lower corporate tax rate and a tax holiday for companies who repatriate overseas profits.

These elements and others will affect different companies in different ways, depending on how much debt they have and other variables. But taken together, they may end up reducing companies’ need to tap the bond market to finance things such as capital spending and share buybacks.

Congress appears to be on track to pass the bill this week. Here’s our take on a few of the possible outcomes for US corporate credit:

A Gentle Nudge to Reduce Debt

By lowering the corporate tax rate (from 35% to 21%) and capping deductibility of interest, the tax plan would raise the relative cost of debt versus equity. That should encourage companies to reduce their leverage. But don’t expect a sea change here. The reduction will probably be modest, since the after-tax cost of debt will remain low by most measures.

Capping Interest Deductibility: Most Issuers Can Handle It

Limiting how much interest expense companies can deduct from their tax bill, on the other hand, would seem to spell trouble for corporate bottom lines, especially during recessions. We’re not so sure.

Only debt that exceeds the cap would be affected and, in most cases, this will be more than offset by the lower tax rate. We estimate that the bill will affect only one-third of high-yield companies and would have virtually no impact on investment-grade ones. Even with the new provision, corporations will continue to deploy a wide range of other strategies designed to limit their taxes.

The effect on cash flow should be positive for most companies, and only modestly negative for the highly leveraged CCC-rated high-yield issuers that will be most affected by the interest deduction cap.

Restarting the M&A Engine?

Mergers and acquisition (M&A) activity is down about 37% in 2017 but could pick up if more clarity on tax policy and stronger economic growth boost corporate confidence. That may be tempered somewhat by tighter monetary policy and higher financing costs, but overall interest rates are likely to remain low by historical standards in 2018.

On the other hand, limits on interest deductibility probably bode poorly for leveraged buyouts (LBOs), which affect the riskiest part of the corporate credit market. LBOs have declined as a share of overall M&A activity and may slip even further.

Lower Corporate Tax Rates and Profit Repatriation May Reduce Bond Supply

For years, US companies have moved income offshore to avoid US corporate taxes. At the same time, investor demand for yield has made it easier for them to use debt to finance capital spending and stock buybacks.

The tax changes could slow both of those trends—first by reducing corporate taxes and second by allowing US firms to pay a reduced tax rate on profits stockpiled overseas. A tax cut on repatriated profits is especially relevant, as companies might use this windfall, rather than new debt, to finance future spending and buybacks. That could limit new corporate bond supply and boost outstanding bond prices.

Don’t Count Out the Fed

Much, of course, will depend on the Fed. If tax reform boosts growth and inflation, policymakers could muddy the outlook by raising interest rates more quickly than expected. And it’s still too early to tell how the Fed’s slow but steady unwinding of quantitative easing will affect long-term interest rates and overall financial conditions.

At the Fed’s latest policy meeting, Chair Janet Yellen said new fiscal stimulus might boost growth but not inflation. Most economic experts, including our own, think that’s unlikely. But if she’s right, it’s possible that credit assets and other growth-seeking securities could extend their recent run of strong performance.

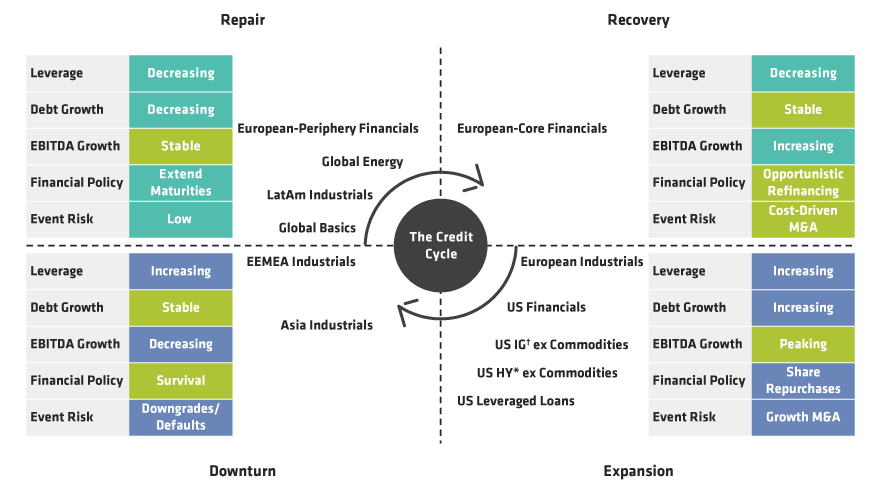

But even the most comprehensive tax reform in decades won’t put an end to the credit cycle. Sooner or later, credit expansion will end. A new tax code could be a net positive for corporate credit in the short run. But we still think investors should pick their spots carefully and be sure to diversify their exposure across regions, sectors and asset classes.