-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

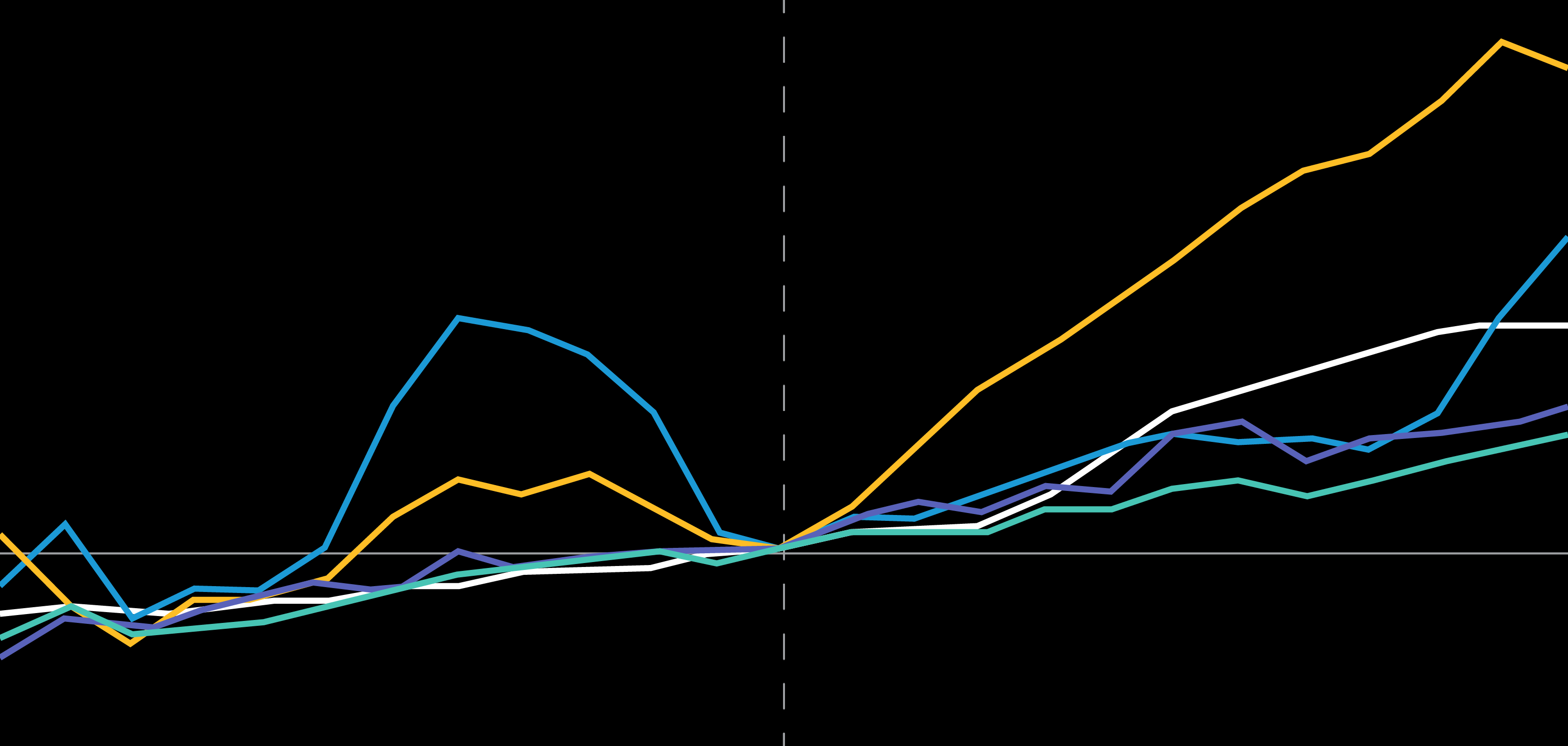

Debt Hangover Looms After US Borrowing Binge

Through June 30, 2018

Past performance does not guarantee future results.

*Based on an equal-weighted universe of stocks in the AllianceBernstein US large-cap universe

†Based on net debt/equity. Excluding financial stocks

Source: Center for Research in Security Prices, IDC, Morningstar Direct, S&P, S&P Compustat, Thomson Reuters I/B/E/S and AllianceBernstein (AB)

Scott Krauthamer is a Senior Vice President and Global Head of Product Management & Strategy, overseeing AB's global investment products across the firm's equity, fixed income and multi-asset strategies. Prior to joining the firm, he held a variety of investment and product-management roles at Legg Mason, U.S. Trust, Bank of America and J.P. Morgan Private Bank. Krauthamer started his career as an analyst at J.P. Morgan in 1998, and his financial-services experience spans investment-management, quantitative analysis, marketing and business development. He holds a BS in finance and management information systems from the State University of New York, Albany, and is a CFA charterholder and a CAIA designee. Location: Nashville

Walt Czaicki serves as a Senior Vice President and Senior Investment Strategist for Equities at AB. He rejoined the firm in 2015 and has been in the investment-management industry since 1986. Czaicki's roles have ranged from a fundamental equity research analyst and portfolio manager to chief investment officer. Prior to rejoining AB, he worked on the buy side for a Regions Financial predecessor organization, as well as at Commerce Trust Company and Bank of America. Czaicki holds a BSBA in finance and an MBA, both from Saint Louis University. He is a CFA charterholder. Location: Dallas