Insights

Showing 1-13 of 104 Results

In short-tempered markets, taking a long view can help investors maintain confidence.

Staying invested in EM stocks can help avoid sacrificing attractive return potential.

Healthcare stocks are in much better shape than equity investors might think.

US small-cap stocks could get a boost from post-election policy changes.

Historical return patterns suggest that the largest stocks don’t tend to lead markets forever. Past episodes are instructive.

Emerging-market corporates have historically performed well across market cycles. Here’s why.

Rate cuts amid economic resilience suggest a soft landing and contribute to a supportive climate for risk assets.

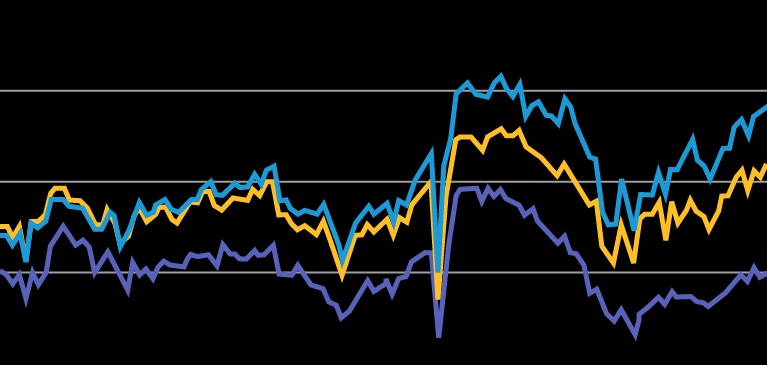

Diversification within equities could help portfolios handle unexpected macro twists.

Recent market volatility has reinforced the importance of casting a wider net to find attractively valued companies for equity portfolios.

After a rapid ascent, issuance of ESG-labeled bonds has fallen back recently, even as we’ve observed that the overall quality of the market has improved.

US quality growth stocks could help multi-asset strategies in a complicated economic backdrop.

Usually, shorter-term high-yield debt yields less than longer-term debt. Not today.

Stronger fundamentals and higher yields? Investors should sit up and take notice.