Are high-yield bonds cheap today? Relative to history, yes. But they’re not all alike. That’s why using a passive exchange-traded fund (ETF) to tap into the market can be costly.

High-yield mutual funds and ETFs have both pulled in money at a rapid clip over the past month. That makes sense: after an extended sell-off, high-yield bonds—particularly in the US—look attractive compared to other return-seeking assets, including equities.

But how investors access the market—via an active mutual fund or a passive ETF—matters. After downturns in 2008, 2011 and 2013, investors who blindly bought the market did well. That approach won’t work this time. US high yield is late in the credit cycle. Even at current valuations, disciplined credit selection is more important than ever.

A Tale of Two (Hypothetical) Bonds

To get a sense of what we mean, imagine a scenario where credit research turns up two hypothetical high-yield bonds, both trading at a discount and offering attractive yields.

Let’s say the first bond was issued by a firm in the food and beverages industry, the highest-performing sector in the US high-yield index last year. The company has strong fundamentals and benefits from lower commodity prices and an improving US economy.

The second offers an even higher yield. But the issuer, an oil exploration and production company, has watched the recent collapse in oil prices cut into its revenues and shrink its margins. Default is a distinct possibility.

If the investor in this scenario is comfortable owning both, then he should buy an ETF. If not, we think an active strategy is a much better way to go.

Passive Strategies and Bonds: A Poor Fit

Here’s why: ETFs track an index, so their asset allocation must mirror that of the index. An active manager, on the other hand, can isolate the securities or sectors she thinks are most likely to do well and avoid those that look risky.

Indexing is especially tricky in fixed income. This is because the companies that have issued the most debt become the biggest weights in the index. So when you invest in a bond ETF, you’re lending the most to the biggest debtors. In a market like high yield, that’s not an ideal strategy. It’s akin to turning over the keys to your portfolio to issuers, whose interests are rarely the same as investors’.

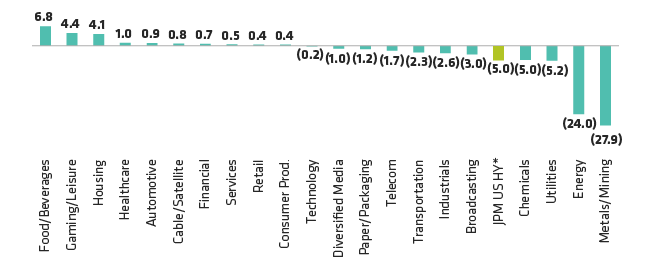

For example, energy-sector companies became the biggest weight in the index in recent years by borrowing heavily when oil prices were high. Then prices began to plunge. By the end of last year, the energy sector—by that point, the market’s largest—was one of its worst performers (Display).