-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Is Europe Facing Another Banking Crisis?

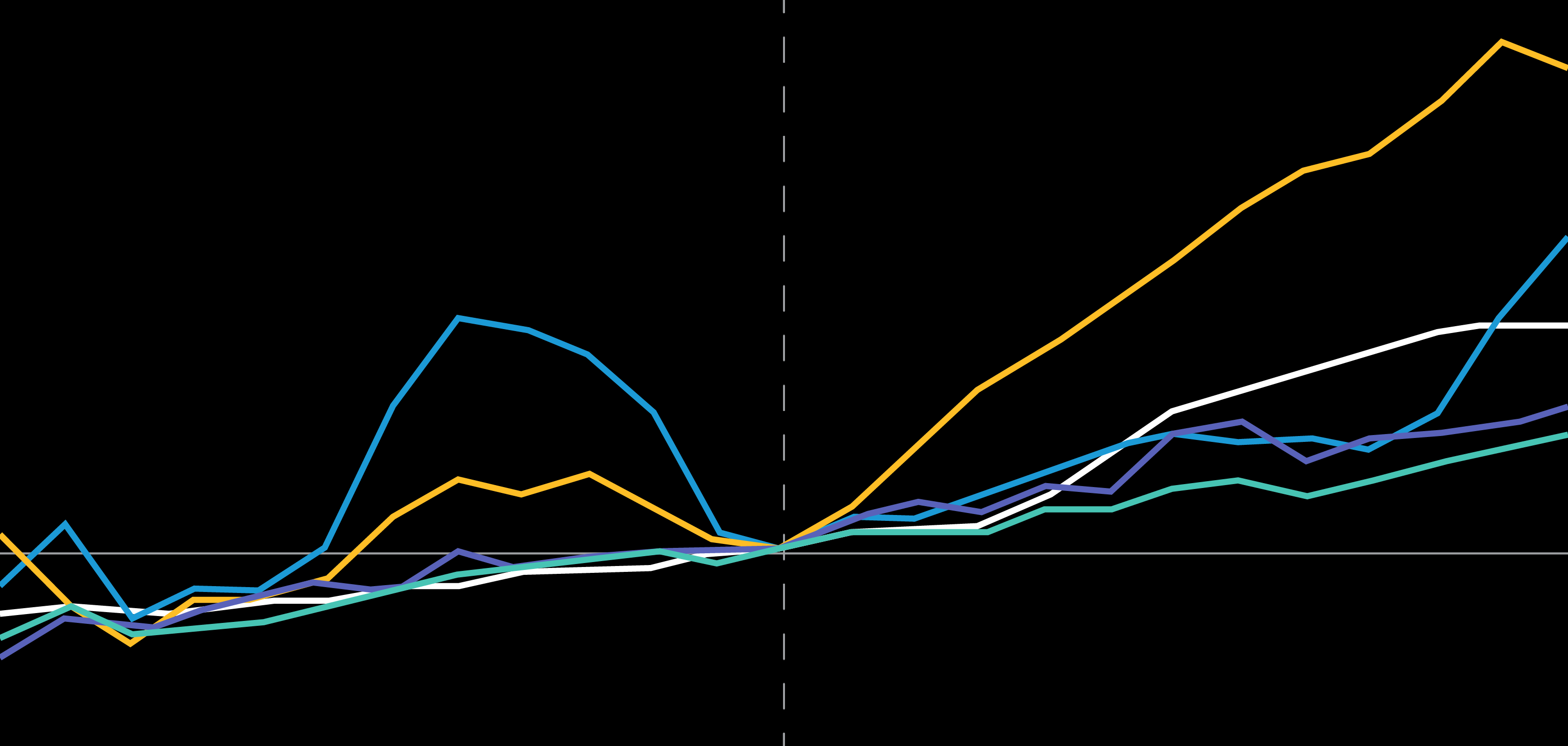

Past performance and current analysis do not guarantee future results.

*Based on net interest income from 48 European banks.

†Percent change in consensus earnings per share (EPS) estimates for calendar year 2023 on April 19, 2023, vs. estimates three months earlier.

Left display through April 18, 2023; right display as of April 19, 2023

Source: Autonomous Research, FactSet, MSCI and AllianceBernstein (AB)

Past performance and current analysis do not guarantee future results.

Through April 18, 2023

Source: Bloomberg, STOXX and AB

Andrew Birse was appointed Chief Investment Officer of European Value Equities in November 2022 after serving as portfolio manager of European Value Equities since March 2016. He has also served as Chief Investment Officer of International Small Cap Equities since 2021 and has managed the International Small Cap and European Small Cap Equities services since inception in 2014 and 2017, respectively. Prior to joining the firm as a research analyst in 2010, Birse spent seven years in the Corporate Finance Group at McKinsey & Company, working in the firm's London, Sydney and Auckland offices. He holds a BCom (honors) in finance and a BA in history and economics from the University of Auckland, and an MSc in economics and philosophy from the London School of Economics. Location: New Zealand

Jane Bleeg was appointed Portfolio Manager of European Value Equities in November 2022. Prior to this she was a senior research analyst responsible for European healthcare and consumer discretionary companies for the Value Equities Group. Before joining the firm in 2016, Bleeg was an engagement manager in the life sciences practice of L.E.K. Consulting, a hedge-fund analyst at Great Point Partners and an investment banking analyst in the Healthcare Investment Banking Group at Piper Jaffray & Co. She holds a BBA (magna cum laude) in finance from the University of Notre Dame and an MBA (with distinction) from Saïd Business School at the University of Oxford. Location: London