Widening the Opportunity Set

How investors add EM corporates to an existing fixed-income allocation will depend to some extent on their individual needs and comfort level. For institutional investors with dedicated EM mandates to hard- and local-currency sovereign bonds, it can be as easy as adding a stand-alone allocation to EM corporates.

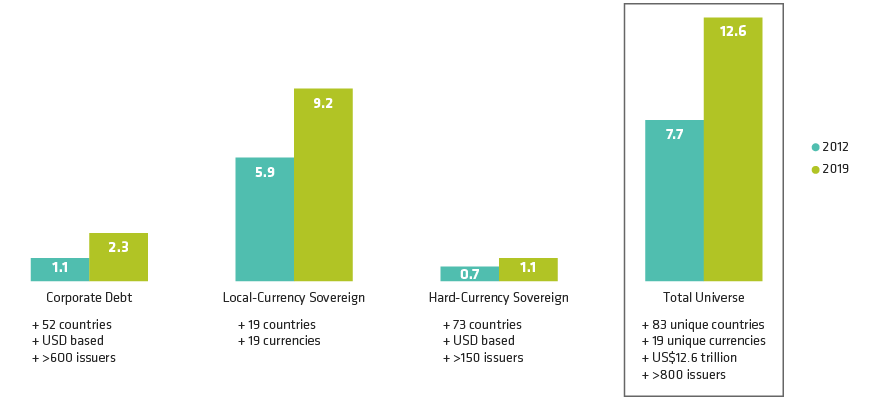

An allocation to corporate debt provides diversification through exposure to more countries and to different parts of the credit cycle. It also gives investors access to a wider range of issuers in different sectors, often with a spread pickup over EM sovereign debt.

The Limits of a Sovereign-Only Allocation

Investors with discretionary mandates who entrust their allocation to a manager might benefit from a blended approach that adds corporates to the 50/50 mix of hard- and local-currency sovereign debt that most investors use today.

Again, diversification and downside protection are key. For example, a sharp rise in the US dollar—and a corresponding slide in EM currencies—hit local-currency sovereigns hard between 2013 and 2016 and wreaked havoc on traditional 50/50 blended strategies.

An allocation to hard-currency corporates would have diversified the currency risk in the 50/50 blend by giving investors exposure to companies with dollar-denominated export revenues. For these types of issuers, a rising dollar was good news because it boosted margins and cash flow.

In 2015, there was a 16.7% difference in annual returns for hard-currency corporates and local-currency sovereigns. Such disparities aren’t unusual.

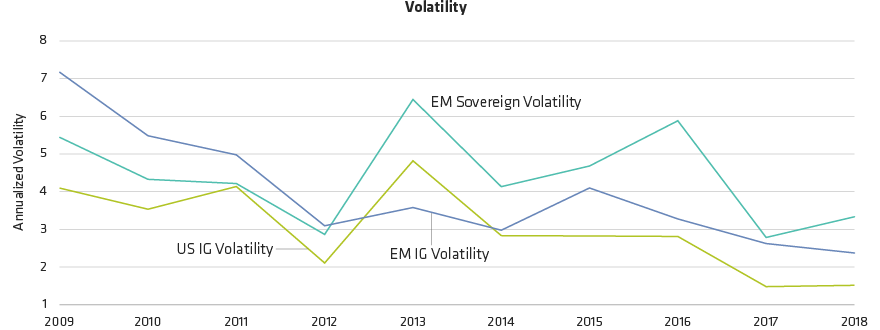

High Quality—and Lower Volatility

Institutional investors with a lower risk tolerance might consider getting exposure to emerging-market debt (EMD) through an investment-grade only approach, split between sovereign and corporate debt. This is an increasingly popular strategy among insurance companies, pension funds and others who have traditionally focused on developed-market (DM) credit exposure.

Adding investment-grade EM corporates can give investors high quality with attractive yields. That’s because yields are higher than those on comparably rated debt from US companies—an important consideration at a time when low interest rates globally are making it harder than ever for investors to generate income.

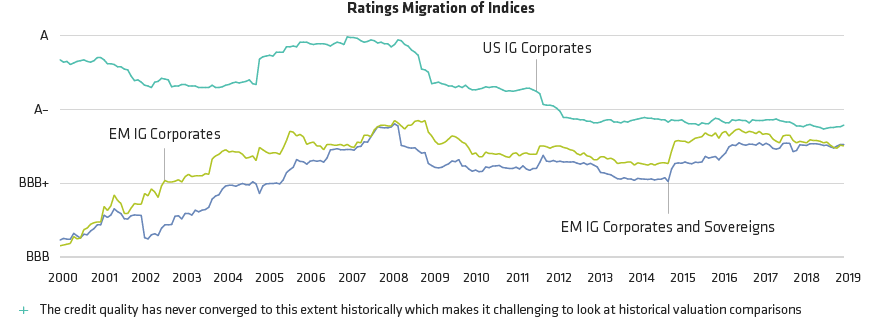

And in recent years, the average credit quality of investment-grade EM corporate debt has converged with that of US investment-grade bonds. In fact, there’s never been such a small gap between the average ratings of the two sectors (Display 2).