Investors attempting to hide from rising rates by choosing investments with significant amounts of CCC-rated corporate bonds could be whistling in the dark—and exposing themselves to a more ominous kind of risk.

As the US Federal Reserve makes plans to raise interest rates, many investors fear the fallout on their fixed-income portfolios. But trying to avoid interest-rate risk by investing in funds with an abundance of CCC-rated corporate bonds—the riskiest part of the high-yield bond market—may not be a sensible alternative.

Beware Credit Risk

While it’s true that CCC bonds have little to no interest-rate risk, what has an even more terrifying effect on a portfolio is credit risk, or the chance of a bond defaulting. Interest-rate risk, on the other hand, may be resolved over time, as portfolios tend to bounce back after a while.

When it comes to high yield, CCC-rated bonds can look enticing, but it’s usually best to steer clear of them. Their higher yields are a lure to investors—and we occasionally do see opportunities in that part of the market. But as we’ve been saying for some time, the rewards seem too little to justify the risk.

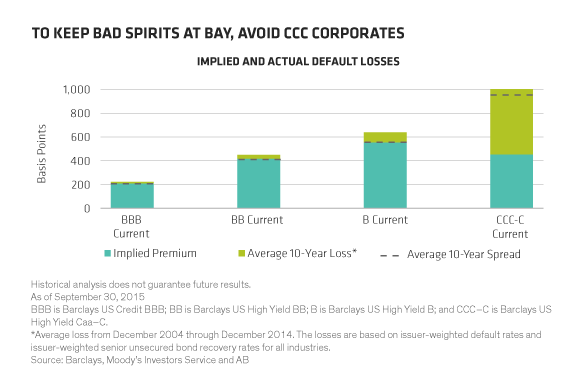

So far in 2015, CCCs are down 6.5%, while BB-rated bonds are up 1%. And on a risk-adjusted basis, CCCs look unattractive. After adjusting their yield spreads by the expected default losses, CCCs and lower-rated bonds actually offer lower yield premiums than B-rated bonds—and about the same as BB bonds, which have much less credit risk (Display). We expect this environment to continue as we move into the later stages of the credit cycle, because highly levered companies are likely to come under even more pressure.