-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

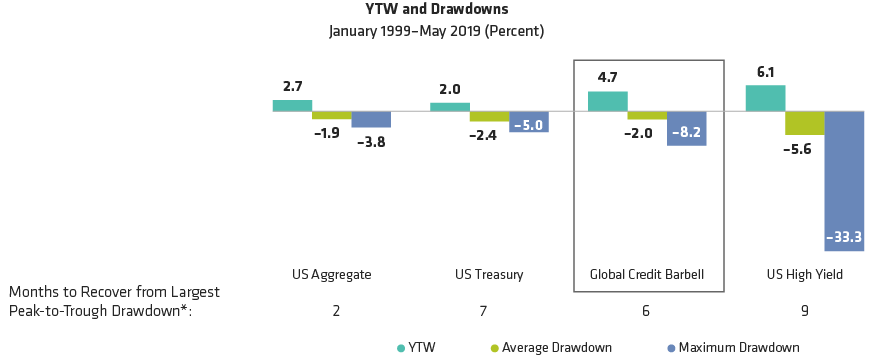

Want to Reduce Downside Risk? A Barbell Strategy May Help

As of May 31, 2019

Past performance does not guarantee future results.

YTW = yield to worst

Any benchmark or index cited herein is for comparison purposes only. An investor generally cannot invest in an index. The unmanaged index does not reflect fees and expenses associated with the active management of an AllianceBernstein (AB) portfolio. US Aggregate is represented by Bloomberg Barclays US Aggregate Bond; US

Treasury by

Bloomberg Barclays US Treasury; global credit barbell is a hypothetical risk-weighted portfolio made up of 65% Bloomberg Barclays US Treasury and 35% Bloomberg

Barclays Global High-Yield; US high yield by Bloomberg Barclays US Corporate High-Yield. *Number of months it took to surpass the prior peak following the trough of the maximum drawdown period.

Source: Bloomberg Barclays, Morningstar Direct and AllianceBernstein (AB)