-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

How Low Can Emerging Markets Go?

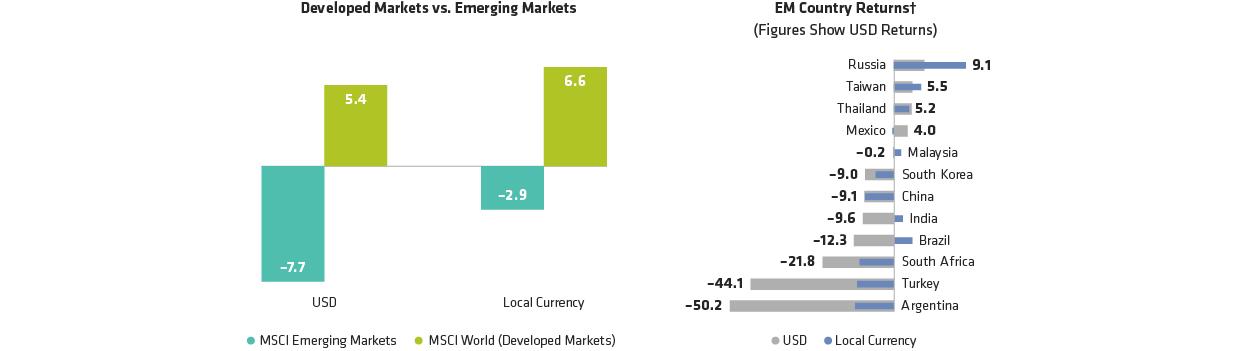

January–September 2018 (Percent)*

As of September 30, 2018

*Net returns

†Chart shows 10 largest constituents of the MSCI Emerging Markets Index by country weight plus Turkey and Argentina. Argentina is not a member of the index.

Source: Bloomberg, MSCI and AllianceBernstein (AB)

-

Devaluation—devaluing the renminbi is the easiest way to combat the symptoms of a trade war. It would make Chinese exports more competitive on world markets, and could help offset much of the potential damage from tariffs. But too much depreciation could prompt Chinese citizens to start shipping their money out of the country, which would weaken the domestic economy and create a vicious cycle. And a devaluation policy may only spark further retaliation from the US.

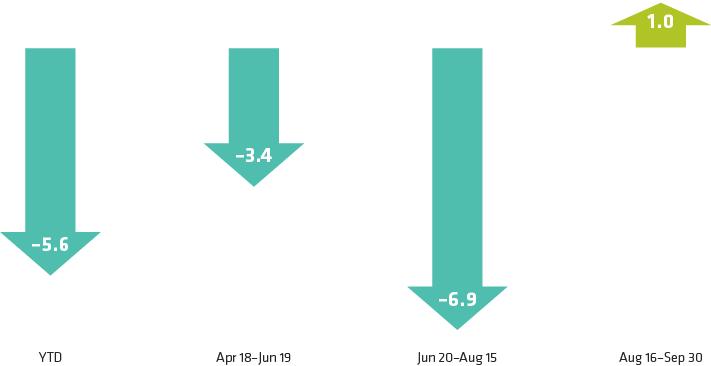

There are some mitigating factors, however. First, the renminbi’s depreciation has been modest so far—after depreciating sharply from June 19 through August 15 this year, the currency has actually appreciated (Display). Second, policymakers are acutely aware that devaluation is a double-edged sword. Indeed, Chinese Premier Li Keqiang said on September 19 that a devaluation would “do more harm than good.” Third, we believe that Chinese policymakers have learned lessons from previous currency episodes; controls to prevent capital flight have been tightened, which would help minimize the impact of any devaluation to the stability of its financial system.China Is Likely to Be Cautious with Renminbi DepreciationChinese Renminbi vs. USD (Percent Change)

As of September 30, 2018

Source: Bloomberg and AllianceBernstein (AB) -

Fiscal Stimulus—if channeled to the right places, stimulus could go a long way toward supporting Chinese economic growth. New infrastructure projects in certain areas could generate tangible returns. For example, Beijing has a population of 24 million and desperately needs a second airport. Stimulus could also add to China’s debt problems. But we’ve observed that the Chinese financial system has matured; many banks are acutely aware of the dangers of overextending credit. So, some self-regulation should reduce the risk of potential excesses. Still, the type of broad-based stimulus that China embarked on a decade ago may not be realistic in today’s environment.

-

Tax Reform—international observers don’t pay much attention to tax reform, but they should. After recent reforms of value-added taxes, Chinese corporate tax receipts are growing much faster than nominal GDP. According to many economists, this creates fertile ground for a tax cut that could also help stimulate the economy in private enterprise, consumer spending and services.

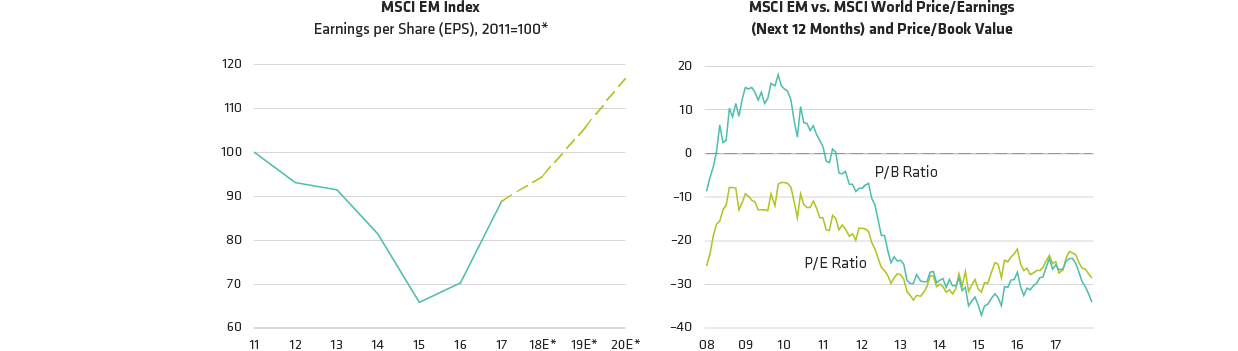

As of September 30, 2018

Past performance and current analysis do not guarantee future results.

In US Dollars

*Based on consensus earnings estimates

Source: FactSet, MSCI and AllianceBernstein (AB)

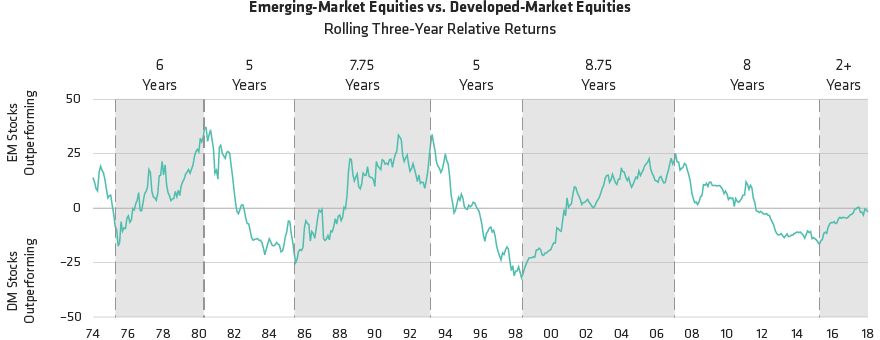

Through September 30, 2018

Past performance and current analysis do not guarantee future results.

Developed-market equities represented by the MSCI World Index. Emerging-market equities represented by the MSCI Emerging Markets Index from its inception in

January 1988 to the present. Prior to 1988, EM equities represented by a 50/50 blend of the MSCI Hong Kong and MSCI Singapore indices

Source: MSCI and AllianceBernstein (AB)

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.