-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

High Yield

The Comeback Kid

12 February 2019

1 min read

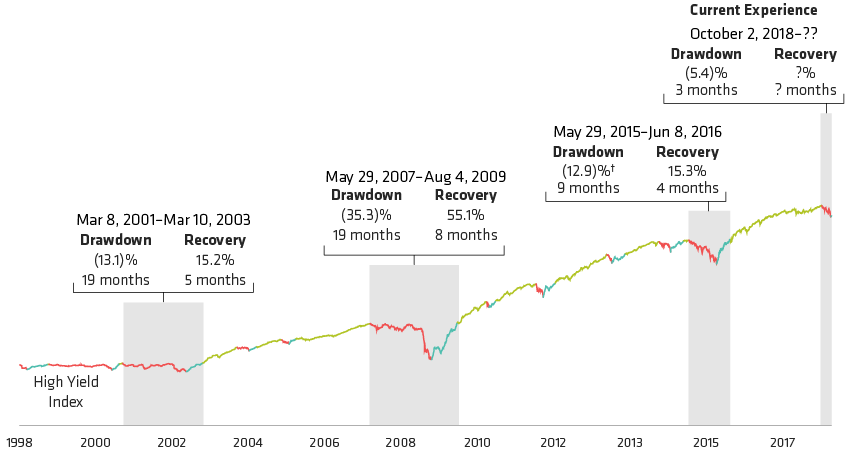

To Understand Today’s High-Yield Market, Look to Past Drawdowns and Recoveries*

Through December 31, 2018; US high yield is represented by the Bloomberg Barclays US High Yield Index.

Past performance is not a guarantee of future results. Individuals cannot invest in an index.

*Recovery is defined as a return to the level of the prior peak

Source: Bloomberg Barclays and AllianceBernstein (AB)