-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

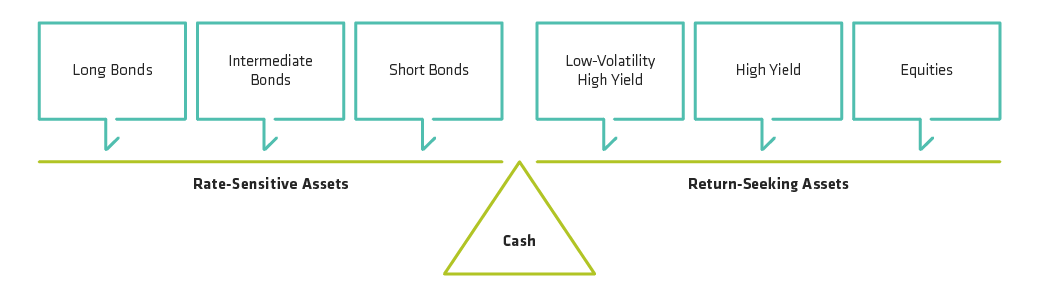

Stressed? A Low Volatility Strategy May Help

For illustrative purposes only.

Gershon Distenfeld is a Senior Vice President, Director of Income Strategies and a member of the firm’s Operating Committee. He is responsible for the portfolio management and strategic growth of AB’s income platform with almost $60B in assets under management. This includes the multiple-award-winning Global High Yield and American Income portfolios, flagship fixed-income funds on the firm’s Luxembourg-domiciled fund platform for non-US investors. Distenfeld also oversees AB’s public leveraged finance business. He joined AB in 1998 as a fixed-income business analyst and served in the following roles: high-yield trader (1999–2002), high-yield portfolio manager (2002–2006), director of High Yield (2006–2015), director of Credit (2015–2018) and co-head of Fixed Income (2018–2023). Distenfeld began his career as an operations analyst supporting Emerging Markets Debt at Lehman Brothers. He holds a BS in finance from the Sy Syms School of Business at Yeshiva University and is a CFA charterholder. Location: Nashville