-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Encouraging Backdrop for Investors as 2018 Gets Under Way

15 January 2018

3 min read

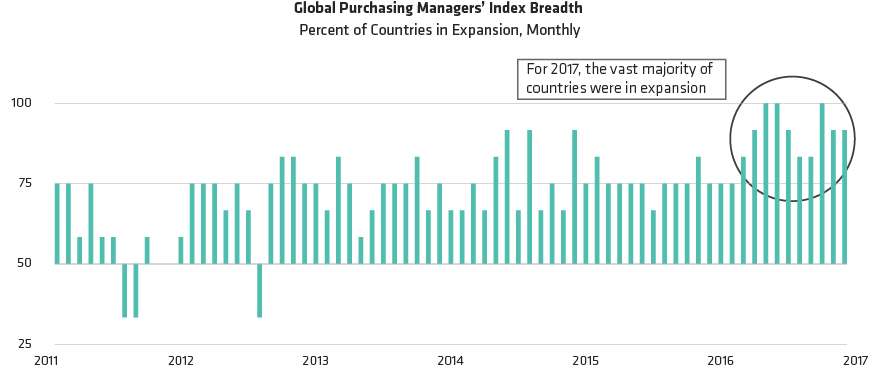

Global Economic Activity Has Been Broad-Based

As of November 30, 2017

Past performance does not guarantee future results. There can be no assurance that any investment objectives will be met.

Global Purchasing Managers’ Index breadth is measured as a sample of 12 countries: US, Germany, France, Spain, Italy, UK, Japan, Brazil, China, India, Russia and Turkey.

Source: Haver Analytics, IHS Markit and AllianceBernstein (AB)

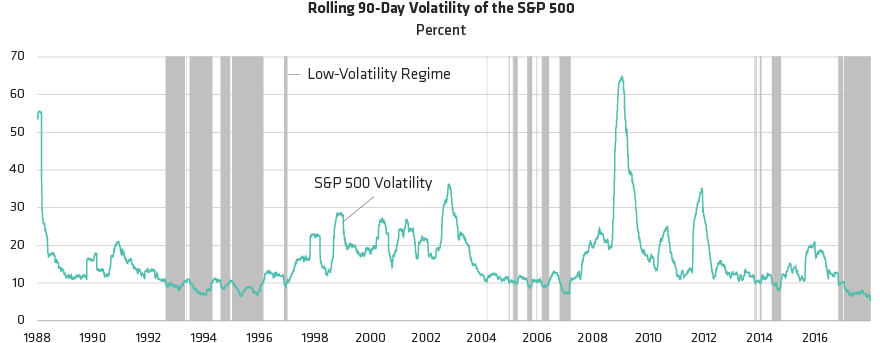

Volatility Has Remained Low for Extended Periods Before

As of December 31, 2017

Low-volatility regime is defined as the bottom quartile of the rolling-volatility period.

Source: Bloomberg, S&P and AllianceBernstein (AB)

About the Authors