-

Past performance, historical and current analyses, and expectations do not guarantee future results. There can be no assurance that any investment objectives will be achieved. The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed here may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor’s personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service sponsored by AB or its affiliates.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

China’s Great Wall of Worry

Myths vs. Realities

05 June 2019

3 min read

3rd

Rank of China’s bond market

among countries, by size

$30.8B

Alibaba online sales,

Singles' Day 2018

2014

The year China declared war

on pollution

Authors

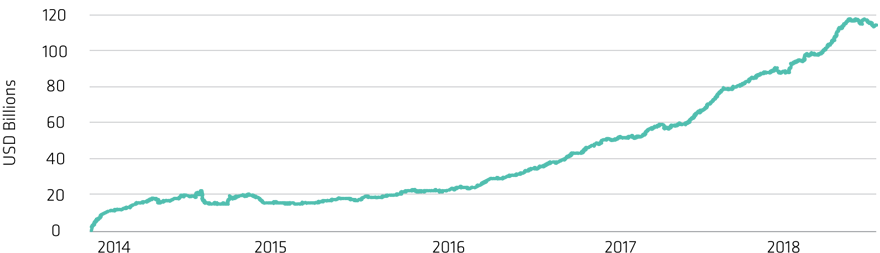

Foreign Flows into China’s Stock Market Have Surged

Cumulative “Northbound” Net Flows into China’s Markets*

Through April 30, 2019

* “Northbound” flows represent flows into onshore Chinese equities (A-shares) via the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect, known collectively as China Connect. IT is used as a gauge of international money flowing into China A-shares.

Source: Bloomberg

About the Authors