Tighter monetary policy in advanced economies. Stretched asset valuations. These are anxious times for income-oriented investors. But don’t worry—it’s still possible to generate income without taking on unnecessary risk.

If you’re a high-yield bond investor, you’ve probably been hearing a lot about how the US credit cycle is drawing to a close. You may even have heard something to that effect from us.

So, is it time to weigh anchor and leave high yield? Hardly. Pulling out simply isn’t an option for investors who rely on their portfolios to deliver a high level of income.

But it may be time to reexamine your high-income strategy. Markets are nearing an inflection point, with central banks finally moving away from quantitative easing, and credit conditions around the world vary. In our view, success in these conditions calls for a global, multi-sector approach that’s focused on reducing risk and maximizing opportunity.

In other words, don’t abandon high-yield bonds. Diversify by adding multiple sources of income to your high-yield allocation. The thinner investors can spread themselves, the better.

Scouting the Markets and the Globe

Why is this approach so important? Because credit cycles, which track the expansion and contraction of credit in an economy, vary.

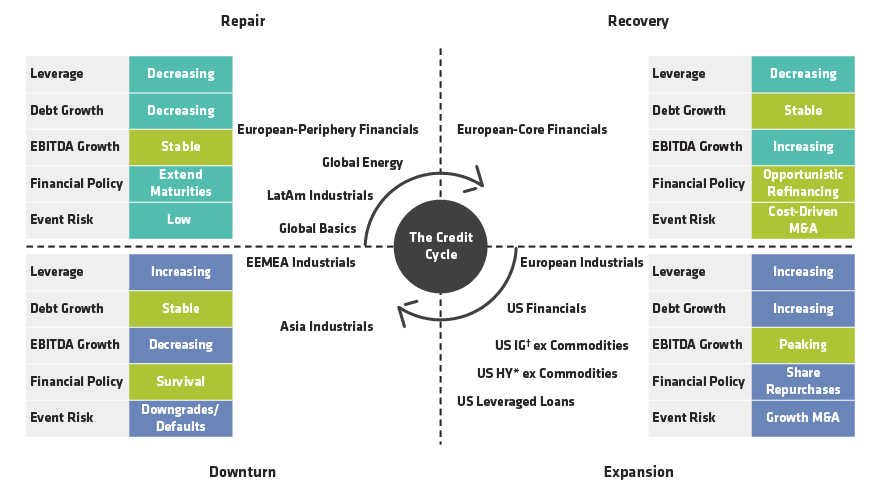

Investors often speak of a single credit cycle, but there are nearly always multiple cycles under way in different sectors and parts of the world. And they all have distinct stages.

For instance, many US assets, including leveraged bank loans and many high-yield and investment-grade corporate bonds, are nearing the contraction stage. This usually coincides with rising borrowing costs, higher debt levels, stingier lenders and a potential decline in asset prices.

Others, such as European financials and Latin American industrials are either in the repair or recovery phase, a period when credit quality and return potential usually improve (Display).