The Bank of Japan (BOJ) surprised the market in December 2022 when it doubled its cap on the 10-year Japanese government bond (JGB) from 0.25% to 0.5%, in response to tighter global monetary policies. The widening interest-rate gap between Japan and other developed economies as other central banks tighten has been a growing concern for the BOJ, which has long held an ultra-easy monetary policy. Thanks to that policy, Japanese fixed-income investors have steered away from their home market for decades, seeking the higher yields of global bond markets.

Below, we address two critical questions: First, will Japan exit its ultra-easy policy mode in 2023? Second, in response to BOJ policy actions, will Japanese bond investors shift their holdings out of hedged foreign bonds and into yen bonds?

The Bank of Japan’s Likely Next Steps

Could the BOJ’s past behavior be a guide to its next steps? Historically, the BOJ has modified its monetary policy toward the end of a global policy cycle. For example, during the natural resource boom of the early to mid-2000s, the US and euro area began tightening in 2004 and 2005, respectively, while Japan tightened in 2006, around the time the Federal Reserve finished tightening and just seven months before it started easing.

Unfortunately, whether that pattern holds in 2023 is anyone’s guess, especially with global inflation still not under control. For now, market participants expect the Fed to finish tightening and begin easing later this year, which would imply imminent BOJ tightening. But these market expectations contradict the Fed’s own projections for the policy rate (higher for longer). And we expect the inflation and economic data driving the Fed and other central banks to remain highly variable for much of the year. That doesn’t give us much visibility into the path for the BOJ.

However, we can get a clearer picture by digging into Japan’s unique situation. In Japan, normalization of monetary policy would begin with unwinding two policies that have been in place for close to a decade—negative interest-rate policy (NIRP) and yield-curve control (YCC)—and would eventually entail adopting a more conventional monetary easing policy, such as quantitative easing.

Already, YCC is under pressure. When the BOJ raised the cap on the benchmark 10-year JGB in December, market expectations for the 10-year yield remained above the 0.5% limit, compelling the BOJ to buy up all market inventory of the benchmark bond to preserve the 0.5% cap. This caused liquidity to evaporate and led to the exclusion of some JGB issues from a major global bond index.

To restore liquidity, we expect the BOJ to eliminate YCC before the end of the year. (We think it’s unlikely that, at that point, interest rates will rise above 1% for the 10-year JGB, considering prevailing inflation trends, the correlation between US Treasury bonds and JGBs, and the yield differentials within the JGB market.)

Meanwhile, we expect Japanese policymakers to maintain NIRP, so long as the dollar-yen exchange rate remains below 150. Although transitioning from NIRP to a zero interest-rate policy—a 10-basis-point increase—would theoretically help promote normalization, there aren’t any technical obstacles to maintaining NIRP, and policymakers could continue to use it as a tool for countering any sharp depreciation in the yen, as we saw in 2022.

Thus, the path to higher—and more competitive—Japanese bond yields isn’t likely to be straight.

Japanese Investors’ Preferences Won’t Change Overnight

Predicting whether Japanese investors will shift their holdings out of foreign debt and into yen bonds requires an appreciation of the factors influencing their decision. Japanese investors consider several factors when deciding whether to invest at home or abroad, one of which is the cost of hedging foreign currencies back to yen.

Compare currency-hedged yields. To fairly compare yields on yen bonds to those on non-yen bonds, we must first subtract the cost of a currency hedge. (While there’s more than one method of currency hedging, we prefer the use of currency swaps to mitigate the risk of exchange-rate fluctuations relative to future cash flows. This method is precise and is especially suitable for fixed-income assets, whose future cash flows are predictable. Other currency-hedging techniques may provide somewhat different results.)

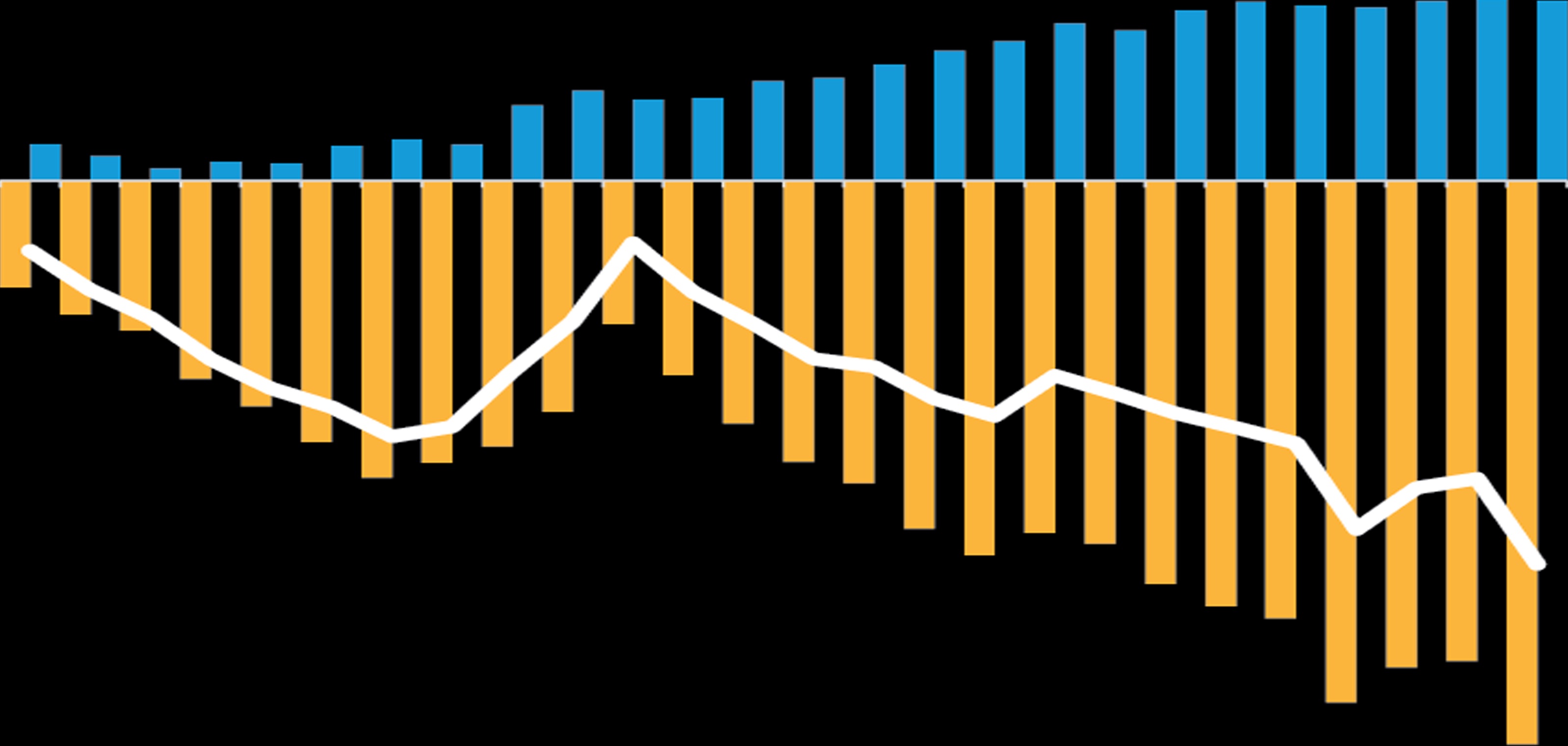

JBGs currently yield 25 to 60 basis points more than US Treasuries after currency hedging (Display), suggesting that Japanese investors may consider moving back to JGBs. Investors with ample US–dollar liquidity, such as US banks, also take advantage of such cross-border yield differences. Indeed, most bondholders of shorter-maturity JGBs are non-Japanese investors.