-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Should European Fixed-Income Investors Take More US Currency Risk?

10 September 2019

3 min read

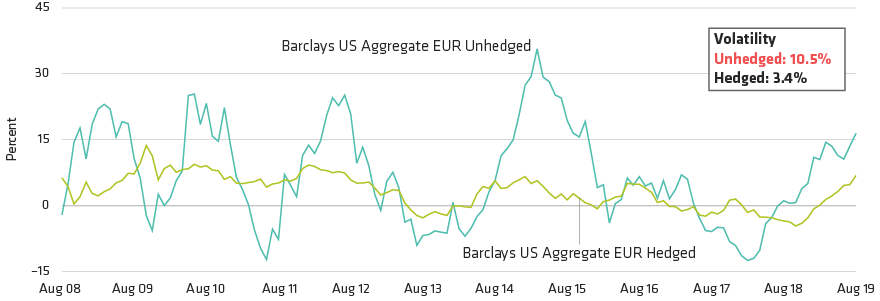

Leaving Currency Exposure Unhedged Dramatically Changes the Risk Profile

Bloomberg Barclays US Aggregate Index Euro Hedged and Unhedged Performance: Rolling 12 Months

Past performance and current analyses do not guarantee future results.

As of August 30, 2019

Source: Bloomberg and AllianceBernstein (AB)

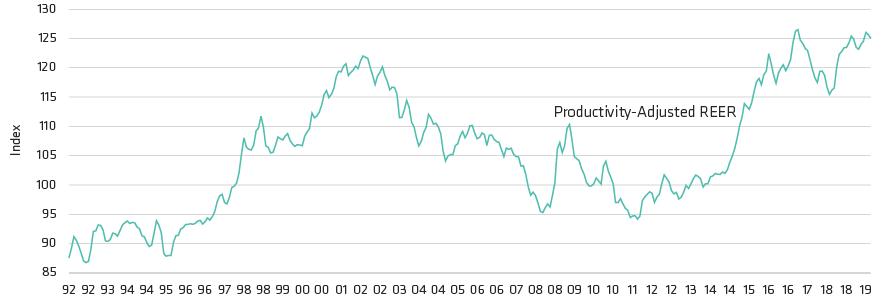

US Dollar Productivity-Adjusted Real Effective Exchange Rate (REER)

The Dollar Is Riding High Against Global Currencies

Past performance and current analyses do not guarantee future results.

Productivity adjustment calculation based on the Harrod-Balassa-Samuelson effect

As of 1993 through June 2019

Source: AllianceBernstein (AB)

About the Author