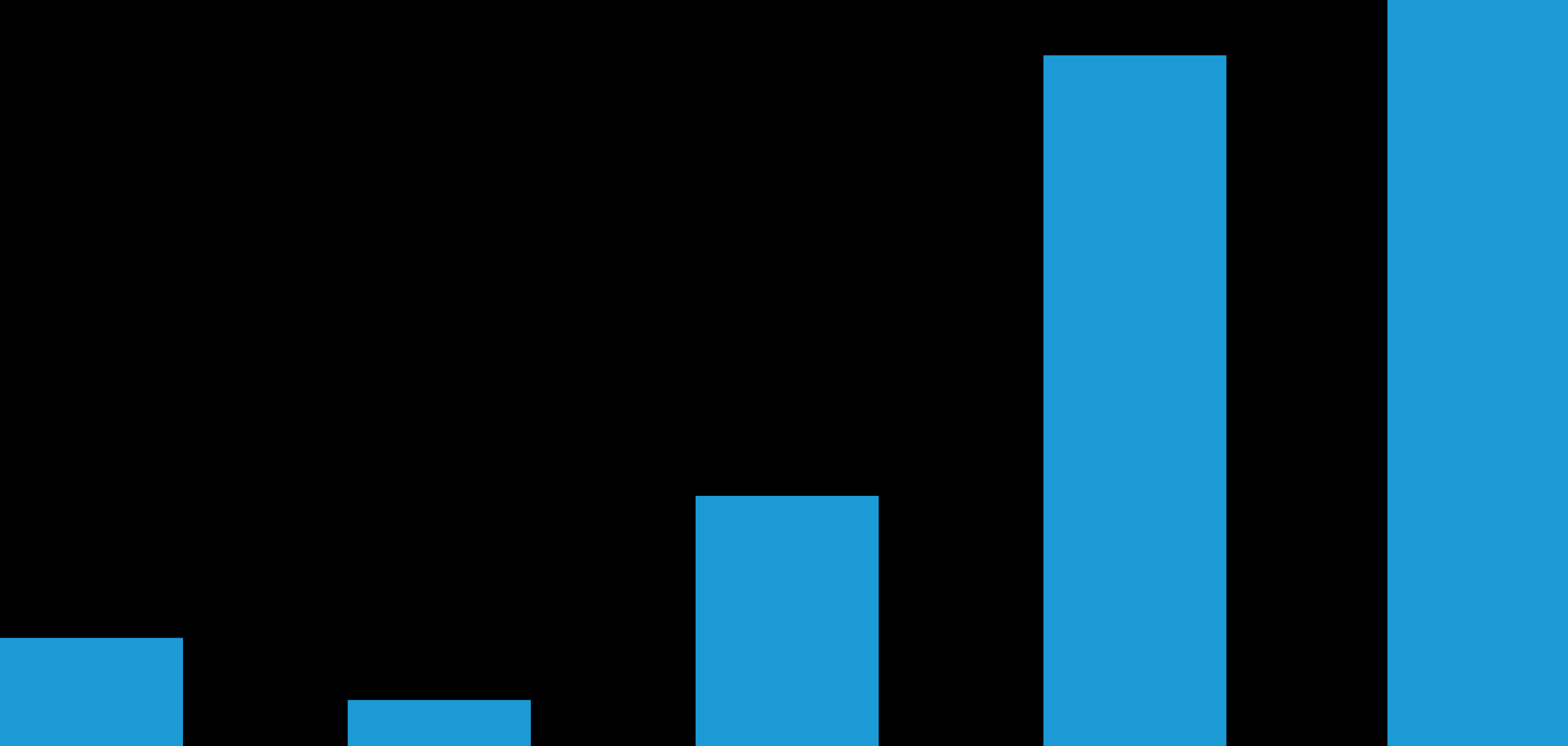

This means 71% of the weeks when the market was down, ETF flows were above average, suggesting investors are “buying the dip” at just about every opportunity. In 2020, flows were above average in just 11% of down weeks, with only two of the year’s 18 weekly declines seeing above-average flows. Arguably 2020 was an unusual year, but extending the timeline still supports the premise that something is up: the average since 2014 was 35%.

This atypical pattern of buying into declining markets has boosted equity performance by adding a “backstop.” Downside price momentum is typically fueled by retail investors selling into market weakness. But recently, investor buying into declining markets has created an opposite effect—with direct impact on returns, recent studies show. Considering the strong flows from ETF buying patterns in recent market downturns, we think the “buy the dip” trend is providing some cushion—at least for now.

It’s possible, in our view, that the “buy the dip” trend has helped keep equity markets steady, despite the handful of sharp downturns. But we don’t think its influence is robust or lasting enough to justify placing substantially more weight on broader equity risk signals when making allocation decisions. In fact, we believe the trend will fade, and August flows already suggest some moderation.

Yet, quantitative curiosity makes “buy the dip” worth a closer look, if only as one of the many factors and signals that guide multi-asset investors.

Record Cash Is the Driving Force

The first question: Why is “buy the dip” so prevalent…and why now? We believe the answer stems from unprecedented levels of sidelined investor cash.

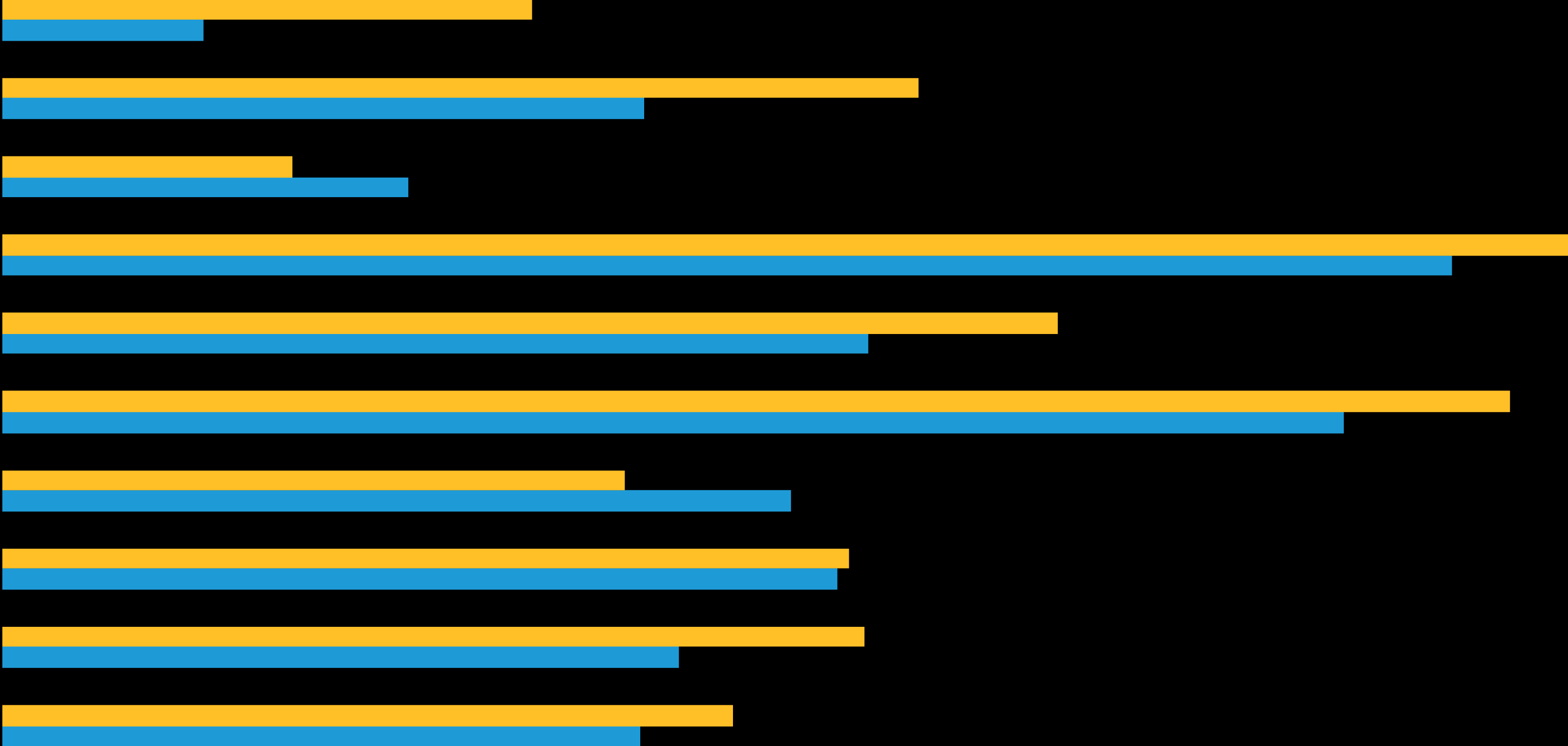

US consumer fundamentals are exceptionally strong—savings since the start of the COVID-19 pandemic were at the fastest clip on record. By March 2021, the personal savings rate—savings left after taxes and spending—was a record 27%, according the Bureau of Economic Analysis. Now hovering at 10%, saving is still well above average. What’s more, the current 6x average net-worth-to-GDP ratio is also a record.

A wave of stimulus checks and a stronger-than-usual impulse to pay down debt and save more all contributed to the record windfall. These fertile cash conditions will likely reverse, however, as economies continue to reopen and consumers resume old spending habits. The pace toward normalization will depend much on COVID-19 vaccination levels and the delta variant, but full throttle economic expansion seems like an eventuality.

In the meantime, with stimulus still in the picture and employment levels healthy, consumer balance sheets should remain a major driver behind investors’ enthusiasm to buy equities, irrespective of returns.

Single Trends Shouldn’t Dominate a Broader Signal Set

The “buy the dip” phenomenon is worth watching, especially when so many risk and return factors can drive a diversified portfolio’s success—but not at the expense of monitoring other, more impactful indicators across asset classes.

Based on our assessments of a diverse group of indicators and fundamentals, our long-term outlook for risk assets like equities remains positive, despite their recent mixed performance. We see a global economy moving steadily back to normal, with pent-up consumer and corporate demand, a robust earnings season, and highly supportive fiscal and monetary policies fueling a measured global recovery. Inflation risks and capacity constraints dot the road ahead, but they’re likely transitory. In our view, this suggests an equity overweight, though a modest one, with a tilt toward quality.

“Buy the dip” can mean different things to different investors, especially bargain hunters. We don’t expect the scale of 2021’s behavior to last, and its impact on portfolio allocation should be minimal. Active multi-asset investors should continue to cast a wide net across stocks, bonds, diversifiers and real assets, observing a broad range of signals in adapting portfolios and staying flexible.