-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

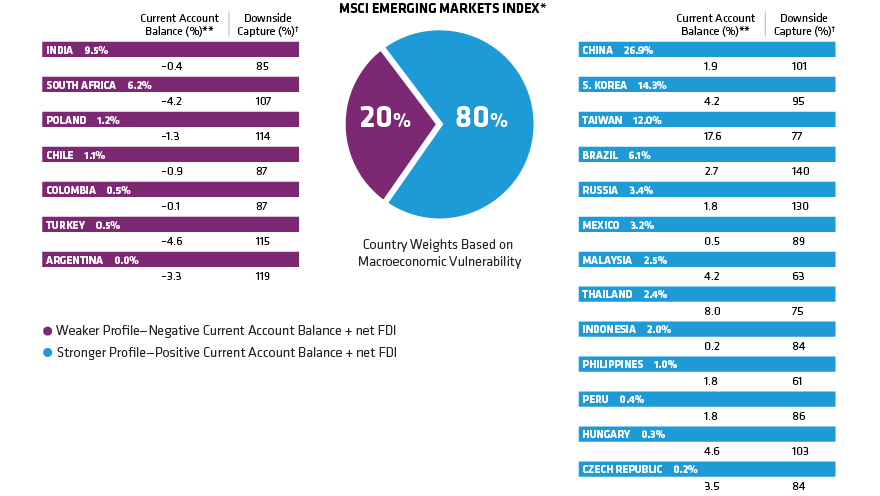

Emerging Markets

It’s Not All About Turkey

Past performance is no guarantee of future results.

As of August 31, 2018

*Countries shown comprise 93.7% of the weight in SCI Emerging Markets. Excludes Hong Kong (4.1%) and six countries that collectively account for 2.1% of the index. Argentina is not in MSCI Emerging Markets, but it is shown for illustrative purposes given its current crisis.

**Current account balance + net foreign direct investment (FDI) as a percentage of GDP for calendar year 2017

†Cumulative down capture in 15 EM sell-offs from October 1, 2007, through August 31, 2018.

Source: Department Administration Nacional de Estadistica (Colombia); Directorate General of Budget, Accounting and Statistics (Taiwan); Central Reserve Bank of Peru; Haver Analytics; International Monetary Fund; MSCI; Oxford Economics and AllianceBernstein (AB)

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.