-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Finding Consistency in Erratic Equity Markets

15 May 2017

3 min read

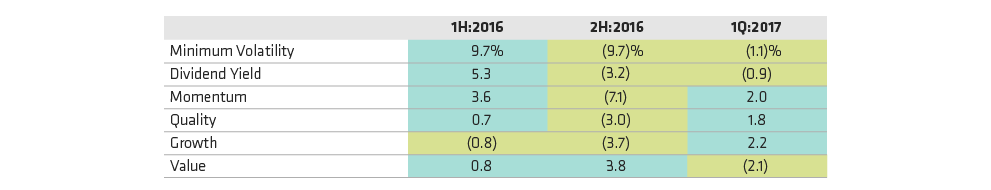

Equity Return Patterns Have Been Very Volatile

Relative Returns of MSCI Factor and Style Indices vs. the MSCI ACWI Cap-Weighted Index

As of March 31, 2017

Source: MSCI and AB

Core Equity Managers’ Performance Has Been Inconsistent

Percent of Managers Outperforming the MSCI ACWI Index, 2016

As of December 31, 2016

Manager returns represented by 245 strategies in the eVestment Global All Cap Core Equity universe relative to MSCI ACWI

Source: eVestment, MSCI and AB

-

AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

About the Authors