-

The views expressed herein do not constitute research, investment advice or trade recommendations, and do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Can Smaller Stocks Recover from Coronavirus Blow?

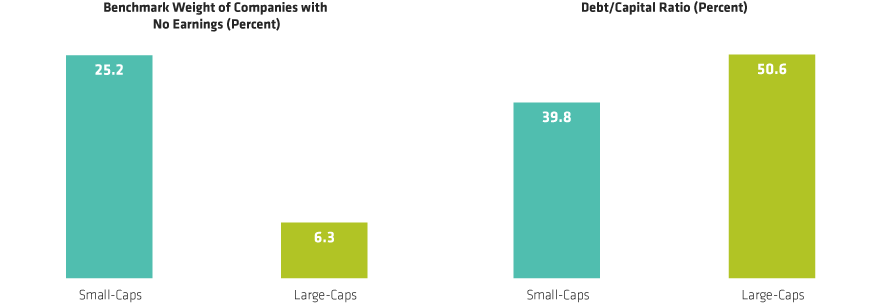

As of March 31, 2020

Small-caps represented by 200. Large-caps represented by Russell 1000.

Source: FactSet, FTSE Russell, Jefferies and AllianceBerntein (AB)

As of April 30, 2020

Source: Russell Investments and AllianceBernstein (AB)

As of March 31, 2020

*Diffusion index based on AB’s US small-cap growth quantitative model that measures the number of estimates revised upward versus estimates revised downward.

Source: Russell Investments and AllianceBernstein (AB)

Samantha S. Lau was named Chief Investment Officer of Small and SMID Cap Growth Equities in October 2023. Previously, she was the co-chief investment officer of Small and SMID Cap Growth Equities since 2014. Lau joined the firm in 1999 as a portfolio manager/analyst responsible for research and portfolio management for the technology sector of AB’s Small and SMID Cap Growth strategies. From 1997 to 1999, Lau covered small-cap technology companies for INVESCO (NY) (formerly Chancellor Capital Management). Before joining Chancellor in 1997, she worked for three years as a healthcare securities analyst in the investment research department of Goldman Sachs. Lau co-chaired the Women’s Leadership Council at AB from 2019 to 2022. She holds a BS (magna cum laude) in finance and accounting from the Wharton School at the University of Pennsylvania and is a CFA charterholder. Location: New York