-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Emerging Markets

It’s Not All About Turkey

Past performance is no guarantee of future results.

As of August 31, 2018

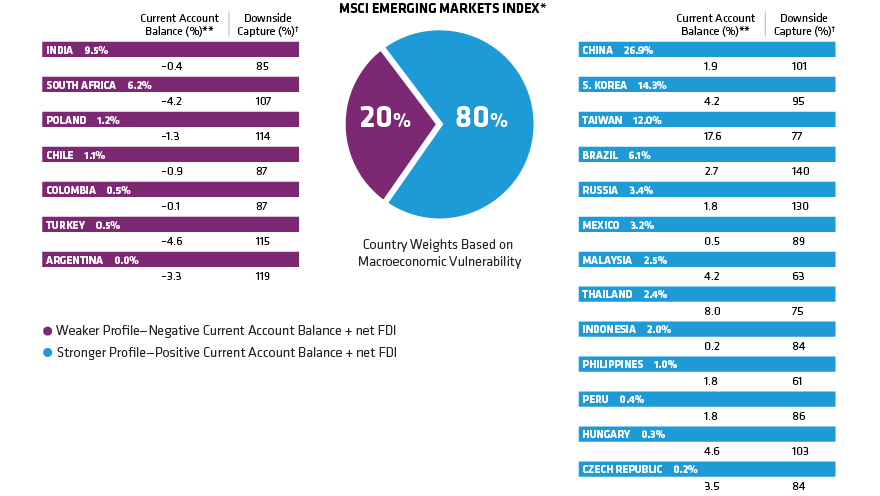

*Countries shown comprise 93.7% of the weight in SCI Emerging Markets. Excludes Hong Kong (4.1%) and six countries that collectively account for 2.1% of the index. Argentina is not in MSCI Emerging Markets, but it is shown for illustrative purposes given its current crisis.

**Current account balance + net foreign direct investment (FDI) as a percentage of GDP for calendar year 2017

†Cumulative down capture in 15 EM sell-offs from October 1, 2007, through August 31, 2018.

Source: Department Administration Nacional de Estadistica (Colombia); Directorate General of Budget, Accounting and Statistics (Taiwan); Central Reserve Bank of Peru; Haver Analytics; International Monetary Fund; MSCI; Oxford Economics and AllianceBernstein (AB)

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

Sammy Suzuki is Head of Emerging Markets Equities, responsible for overseeing AB’s emerging-markets equity business and instrumental in the formation and shaping of AB’s Emerging Markets Equity platform. He was also a key architect of the Strategic Core platform and has managed the Emerging Markets Portfolio since its inception in 2012, and the Global, International and US portfolios from 2015 to 2023. Suzuki has managed portfolios since 2004. From 2010 to 2012, he also held the role of director of Fundamental Value Research, where he managed 50 fundamental analysts globally. Prior to managing portfolios, Suzuki spent a decade as a research analyst. He joined AB in 1994 as a research associate, first covering the capital equipment industry, followed by the technology and global automotive industries. Before joining the firm, Suzuki was a consultant at Bain & Company. He holds both a BSE (magna cum laude) in materials engineering from the School of Engineering and Applied Science, and a BS (magna cum laude) in finance from the Wharton School at the University of Pennsylvania. Suzuki is a CFA charterholder and was previously a member of the Board of the CFA Society New York. He currently serves on the Board of the Association of Asian American Investment Managers. Location: New York