-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

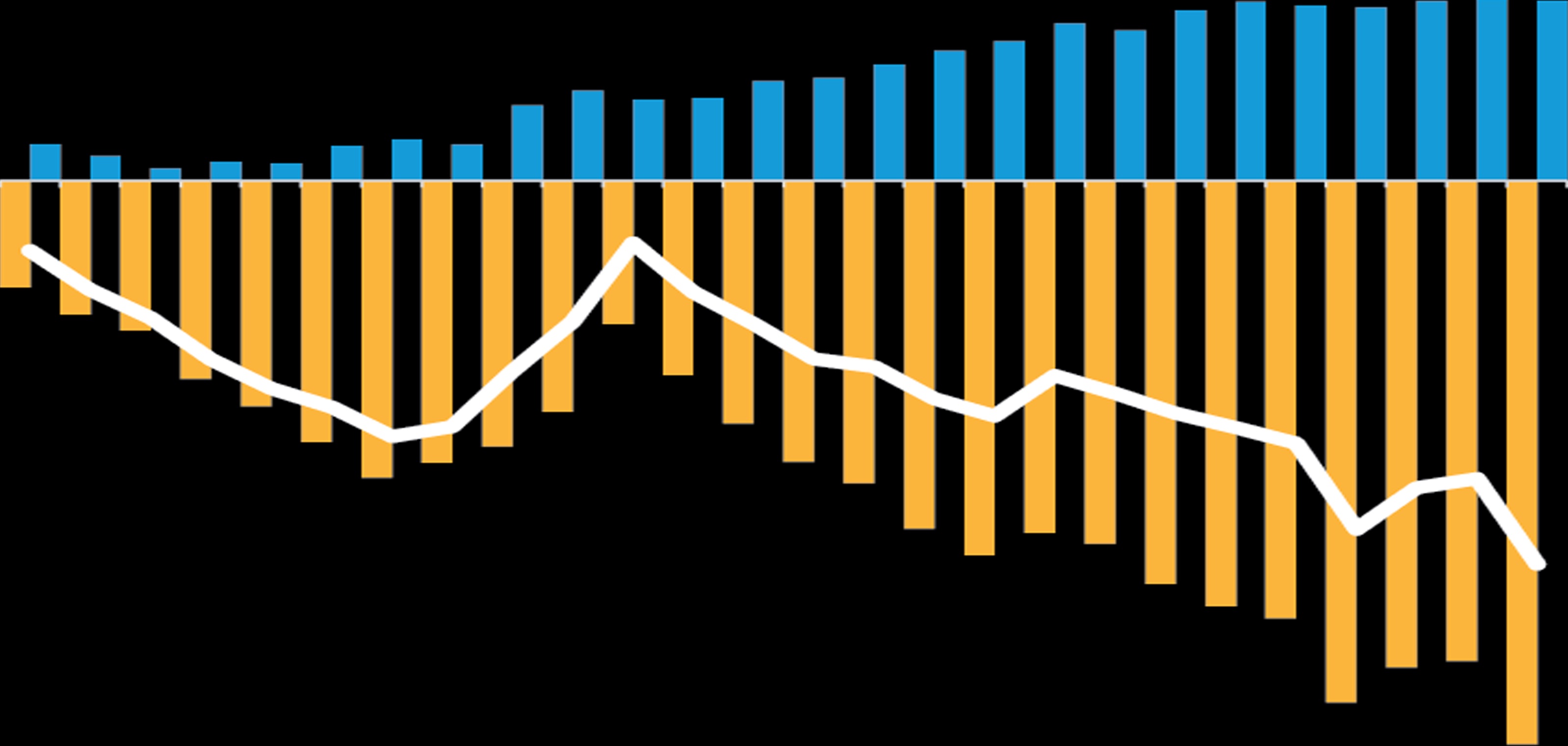

World Economy to Continue Rebalancing in 2025

Past performance does not guarantee future results.

Through December 6, 2024

Source: LSEG Data & Analytics and AllianceBernstein (AB)

Past performance does not guarantee future results.

Through October 31, 2024

Source: LSEG Data & Analytics

Past performance does not guarantee future results.

GFCF: gross fixed capital formation

Through September 30, 2024

Source: Eurostat and AB

Past performance does not guarantee future results.

Dashed line represents a trendline of household deposit data.

Through September 30, 2024

Source: National Bureau of Statistics of China and AB

Eric Winograd is a Senior Vice President and Director of Developed Market Economic Research. He joined the firm in 2017. From 2010 to 2016, Winograd was the senior economist at MKP Capital Management, a US-based diversified alternatives manager. From 2008 to 2010, he was the senior macro strategist at HSBC North America. Earlier in his career, Winograd worked at the Federal Reserve Bank of New York and the World Bank. He holds a BA (cum laude) in Asian studies from Dartmouth College and an MA in international studies from the Paul H. Nitze School of Advanced International Studies. Location: New York

Sandra Rhouma is a Vice President and European economist on the Fixed Income team. Previously, she was a global economist and strategist at Millennium Global Investments, a London-based currency investment manager. From 2019 to 2022, Rhouma worked for the European Central Bank as a banking supervision analyst before moving into a US economist position. She holds a PhD in economics from the University of Surrey and a master’s degree from Paris 1 Panthéon-Sorbonne. Location: London

Eric Liu is a Senior Vice President and Portfolio Manager on the Asia Fixed Income team, focusing on offshore and onshore China, Asia Pacific, and emerging-market fixed-income strategies. Prior to joining AB in 2023, he was head of fixed income and portfolio manager at Harvest Global Investments, responsible for renminbi, Hong Kong–dollar and US-dollar fixed-income strategies. Prior to that, Liu held various fixed-income portfolio management and trading positions at Manulife Investment Management, Citigroup and Standard Chartered. He holds a MSc in investment management from The Hong Kong University of Science and Technology and a BSc (Hons) in computer and management science from the University of Warwick. Location: Hong Kong