Insights

Showing 1-13 of 75 Results

Healthcare stocks are in much better shape than equity investors might think.

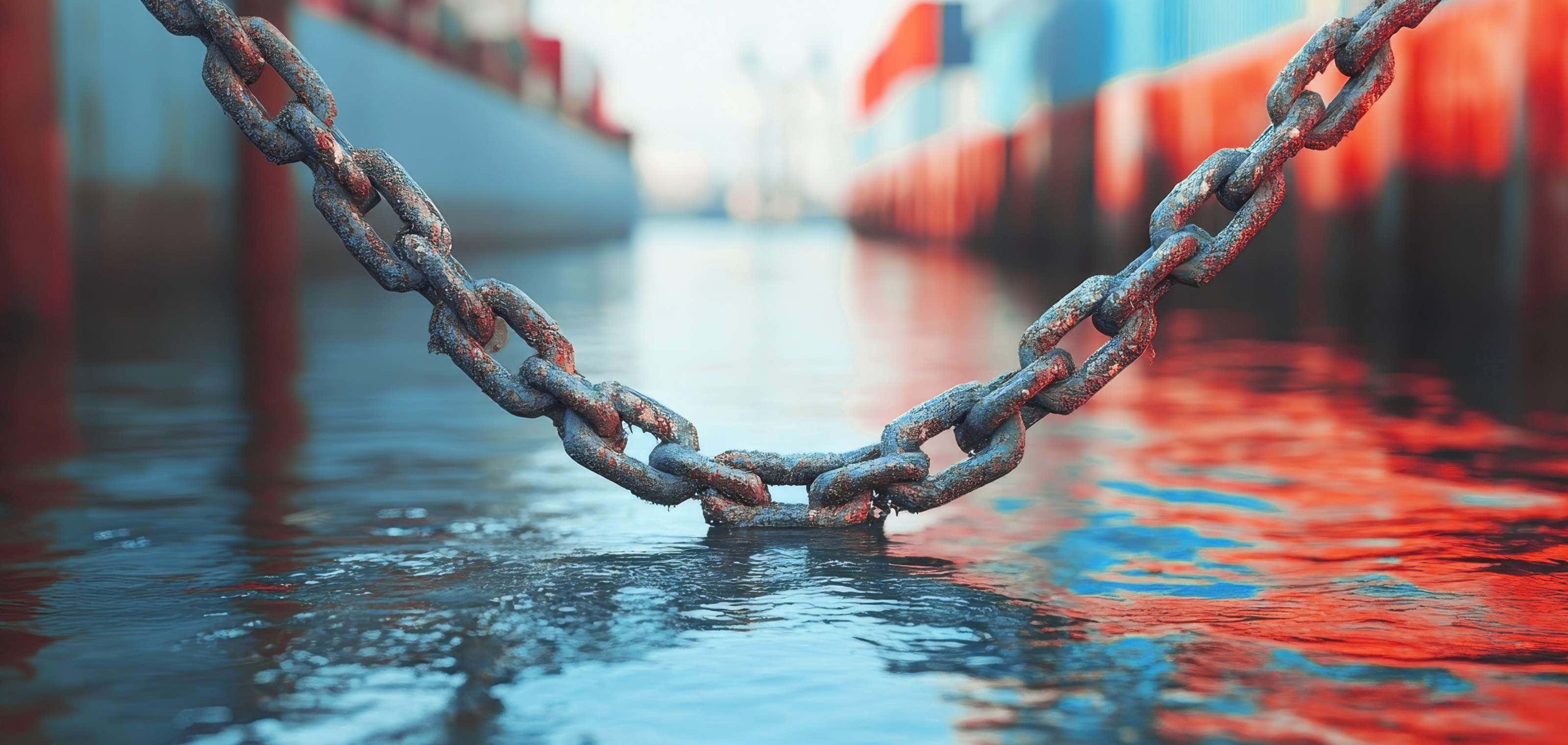

After the trade war’s opening salvoes, tensions seem set to last for some time.

Following a defensive equity playbook can help investors prepare for market volatility in a year of heightened uncertainty.

China’s efforts to steer between domestic and international growth challenges in 2025 could be good for bond investors.

As growth extends to more regions, we see expanding opportunities across countries and assets.

European equity markets may look vulnerable to fallout from new US policies. But some companies offer investors reasons to cheer.

Our investment heads discuss the forces that will shape growth, interest rates and businesses around the world.

Continued volatility, falling yields, and other expectations for the year ahead, plus seven strategies to take advantage.

US small-cap stocks could get a boost from post-election policy changes.

Tax cuts alone can’t save a weak business, but high-quality companies can put a tax-break windfall to good use for investors.

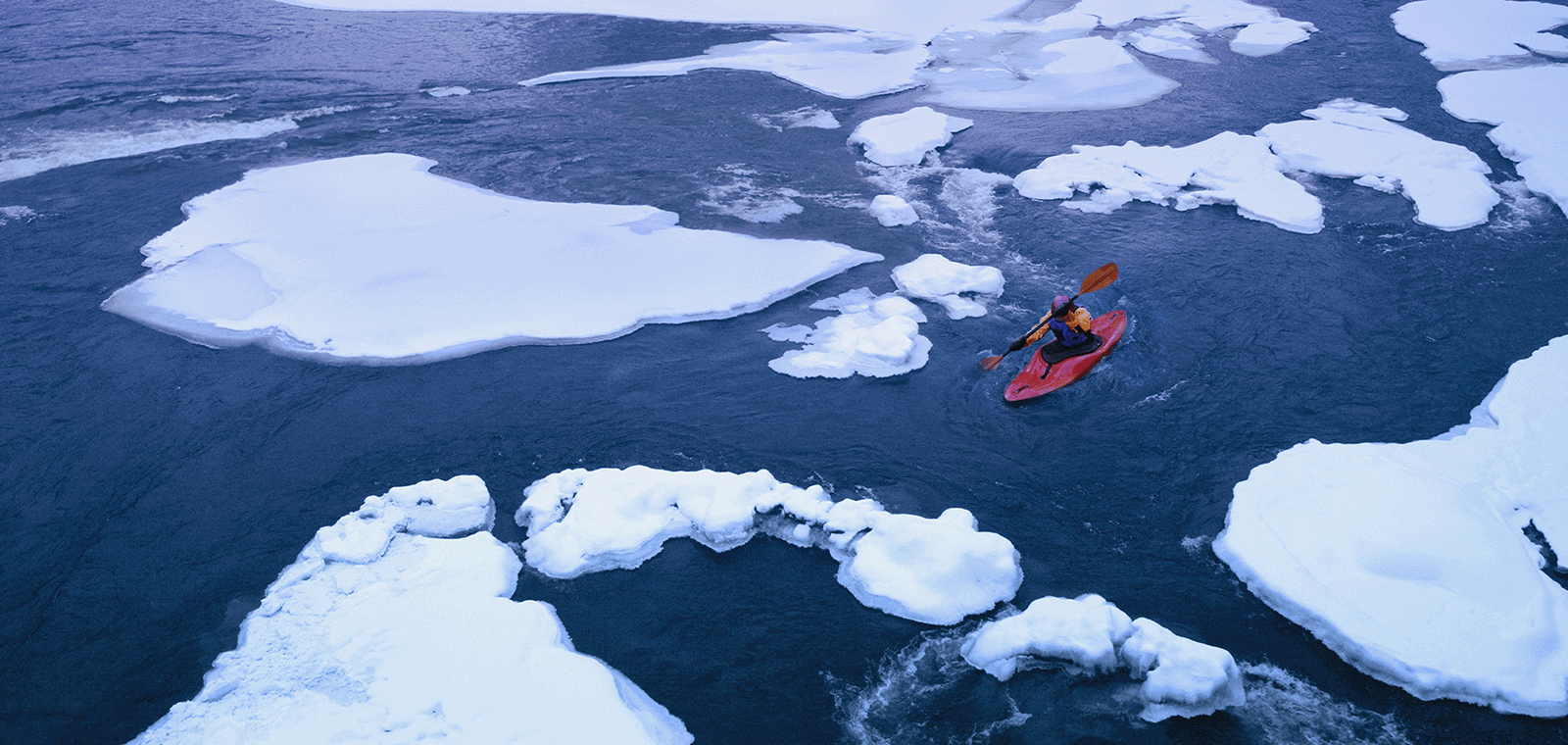

Global markets will face powerful disruptive forces next year. How can investors prepare in fixed-income, equity and alternative investment strategies?

With human rights regulations expanding, investors need a broader approach to assessing risk and opportunity.

Policy changes could reshape return potential for companies across the US market. Here’s how investors can start thinking about the challenges ahead.