Insights

Showing 1-13 of 46 Results

Multi-asset strategies must adapt to a promising—but changeable—environment for generating income.

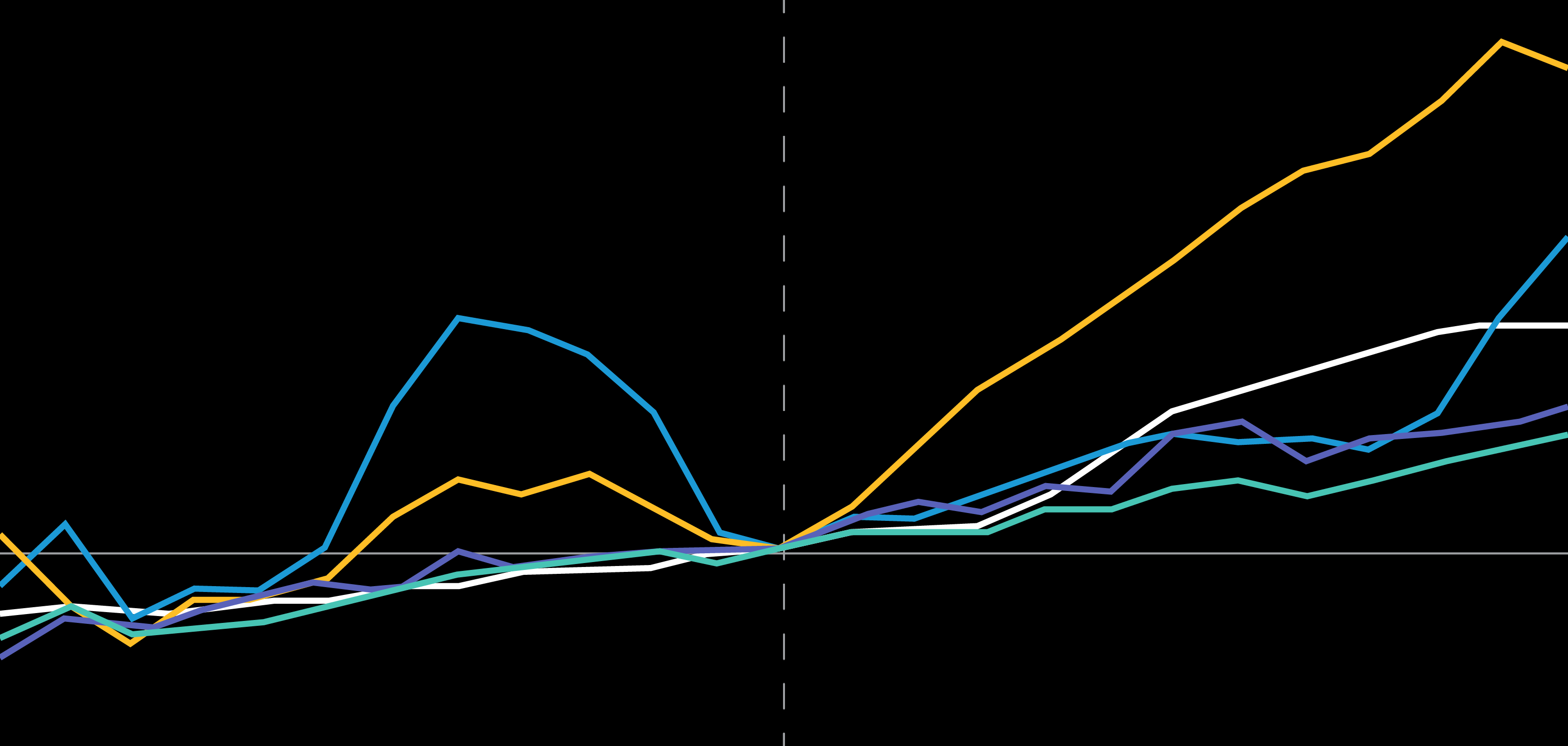

We think today’s market landscape calls for a different mix in multi-asset income strategies

US quality growth stocks could help multi-asset strategies in a complicated economic backdrop.

This may be the right time for multi-asset investors to consider emerging-market assets.

Many investors limit their mandates to credits rated BBB or higher. But they could tap high-quality high yield—without adding to overall risk.

Insurers likely face a very different investment regime today than they have in the past, with higher and more volatile interest rates as well as structurally higher inflation.

For multi-asset income investors, adapting portfolios for equity defense, credit potential and duration exposure should be on the docket for 2024.

There’s been much discussion of AI’s deflationary potential, but this issue must be viewed in the broader context of other megatrends influencing a new investment regime.

With the second half of 2023 underway, how are the macro and market landscapes unfolding?

Emerging-market equities seem tactically attractive versus developed-market stocks, and many investors may be underweight. Strategically, there's a case for considering China as a distinct allocation building block.

Despite recent outperformance, our quant signals remain strongly positive on EM vs. developed-market stocks.

The central market themes for the year continue to be: inflation, central bank tightening, and expectations of lower economic growth. After a volatile period, where are markets headed from here? AB's Senior Investment Strategist, Walt Czaicki, reminds investors that investing is a marathon, not a sprint.

Changing conditions may warrant adding higher duration assets like treasury bonds, which have typically offered better risk/reward outcomes during economic slowdowns.