Each Missouri Target Date Fund has a date in its name. We call this the "target date," the approximate year when you expect to retire and begin withdrawing from your account.

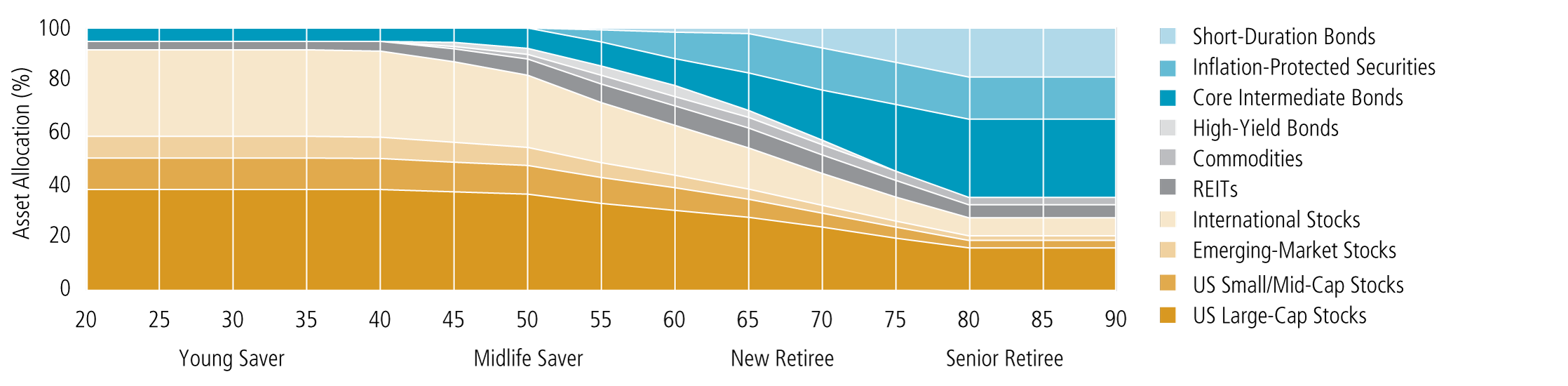

As you move closer to, and eventually into, retirement, your fund automatically adjusts to a more conservative mix of investments.

With a Missouri Target Date Fund, you're spreading your dollars across the many different investment options that make up the fund.

The target date portfolios are custom designed and managed for the MO Deferred Comp Plan by AllianceBernstein L.P., an investment management firm that designs, implements and monitors the asset allocation for the Missouri Target Date Funds. The investment portfolios underlying the Missouri Target Date Funds are managed by several investment providers and were selected by the State of Missouri Deferred Compensation Plan.

Choose the date you expect to retire.

The funds will invest in a mix of investments, including bonds, stocks and diversifiers, and automatically adjust them over time.

You have reached retirement. You may now start to withdraw cash to live on while your remaining savings continue to be invested throughout your retirement.

Asset Allocations

|

Young Saver | Midlife Saver | New Retiree | Senior Retiree | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 20 | 25 | 30 | 35 | 40 | 45 | 50 | 55 | 60 | 65 | 70 | 75 | 80 | 85 | 90 | |

| US Large-Cap Stocks | 38.40% | 38.40% | 38.40% | 38.40% | 38.40% | 37.60% | 36.70% | 33.20% | 30.50% | 27.80% | 24.10% | 20.00% | 16.20% | 16.20% | 16.20% |

| US Small/Mid-Cap Stocks | 12.10 | 12.10 | 12.10 | 12.10 | 11.80 | 11.20 | 10.90 | 9.80 | 8.60 | 7.00 | 5.30 | 4.20 | 2.90 | 2.90 | 2.90 |

| Emerging-Market Stocks | 8.20 | 8.20 | 8.20 | 8.20 | 8.20 | 7.60 | 6.90 | 5.70 | 4.80 | 3.90 | 3.00 | 2.30 | 1.70 | 1.70 | 1.70 |

| International Stocks | 33.10 | 33.10 | 33.10 | 33.10 | 32.80 | 30.70 | 27.60 | 22.90 | 19.10 | 15.70 | 12.20 | 9.10 | 6.90 | 6.90 | 6.90 |

| REITs | 3.20 | 3.20 | 3.20 | 3.20 | 3.80 | 5.00 | 6.10 | 7.10 | 7.30 | 7.50 | 7.00 | 6.30 | 4.90 | 4.90 | 4.90 |

| Commodities | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.90 | 1.80 | 3.30 | 3.70 | 4.10 | 3.90 | 3.60 | 2.90 | 2.90 | 2.90 |

| High-Yield Bonds | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.50 | 2.30 | 3.60 | 4.20 | 2.70 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 |

| Core Intermediate Bonds | 5.00 | 5.00 | 5.00 | 5.00 | 5.00 | 5.50 | 7.70 | 9.20 | 10.20 | 14.20 | 19.10 | 25.40 | 29.80 | 29.80 | 29.80 |

| Inflation-Protected Securities | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.50 | 10.00 | 15.00 | 16.00 | 16.00 | 16.00 | 16.00 | 16.00 |

| Short-Duration Bonds | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.70 | 1.60 | 2.10 | 7.60 | 13.10 | 18.70 | 18.70 | 18.70 |

| UNDERLYING INVESTMENT COMPONENT | Investment Manager | Management Style |

|---|---|---|

| US Large-Cap Stocks | State Street Global Advisors (SSGA) | Passive |

| US Small/Mid-Cap Stocks | State Street Global Advisors (SSGA) | Passive |

| International Stocks | State Street Global Advisors (SSGA) | Passive |

| Emerging-Market Stocks | State Street Global Advisors (SSGA) | Passive |

| REITs | State Street Global Advisors (SSGA) | Passive |

| Commodities | State Street Global Advisors (SSGA) | Passive |

| Core Intermediate Bonds | State Street Global Advisors (SSGA) | Passive |

| Inflation-Protected Securities | State Street Global Advisors (SSGA) | Passive |

| High-Yield Bonds | Vanguard | Active |

| Short-Duration Bonds | BlackRock Institutional Trust Company (BTC) |

Passive |

If you think a Missouri Target Date Fund

is right for you, simply:

To take advantage of a Missouri Target Date Fund,

simply: