Historical analysis does not guarantee future results.

As of September 11, 2024 | Source: EPFR and AB

Market Matters

Money-market funds have been the clear favorite among asset classes in 2024, attracting more than $570 billion of inflows. Does the long-term investment outlook change things?

As Of September 11, 2024 Source: EPFR

After many years of zero-interest-rate policy, investors have recently been able to earn a decent return on cash. US three-month Treasury bills have yielded more than 5% for much of the past year, considerably above the last 15 year average.* The last six months, however, have seen the first outflows from money-market funds. They’re dwarfed by the inflows of recent years, but may be a sign that investors perceive the balance of reward elsewhere.

Equity and bond funds have both seen inflows pick up this year, with global equity funds attracting $390 billion year to date.* Equity inflows, skewed toward the US, have been driven partly by the hope of returns from AI but also by substantial fiscal support and the avoidance of a recession. This situation, however, leaves some investors worried about valuation levels—especially with rates staying higher for longer.

* As Of September 11, 2024 Source: Bloomberg and EPFR

Historical analysis does not guarantee future results.

As of September 11, 2024 | Source: EPFR and AB

With cash yields high, we’ve often heard this question over the past year: If I can earn more than 5% on risk-free assets, why should I bother buying anything else?

Yes, investors worried about equity valuations have a tactical case for holding cash, or at least other fixed income instruments, but that case changes over longer time horizons. We expect inflation to settle higher than its average over the last 30 years, driven by three mega-forces: an aging society, deglobalization and the cost of the energy transition.

In a world of structurally higher inflation, most investors will have to focus on maintaining spending power as their primary goal. We think they’ll need to take on more risk to do it. The need to take more investment risk as a way to defer the bigger problem of losing purchasing power will be a defining feature of how investors adapt to the new investment regime they face.

This case for stocks stems not from their recent strong return, particularly in the US, but because they’ve been one of the best inflation hedges over the long run. As long as inflation hasn’t been extreme, companies have been able to grow their earnings in real, or inflation-adjusted, terms by passing higher costs on to consumers. This means that they have the potential to deliver positive real returns.

As long as inflation hasn’t been extreme, companies have been able to grow their earnings in real, or inflation-adjusted, terms.

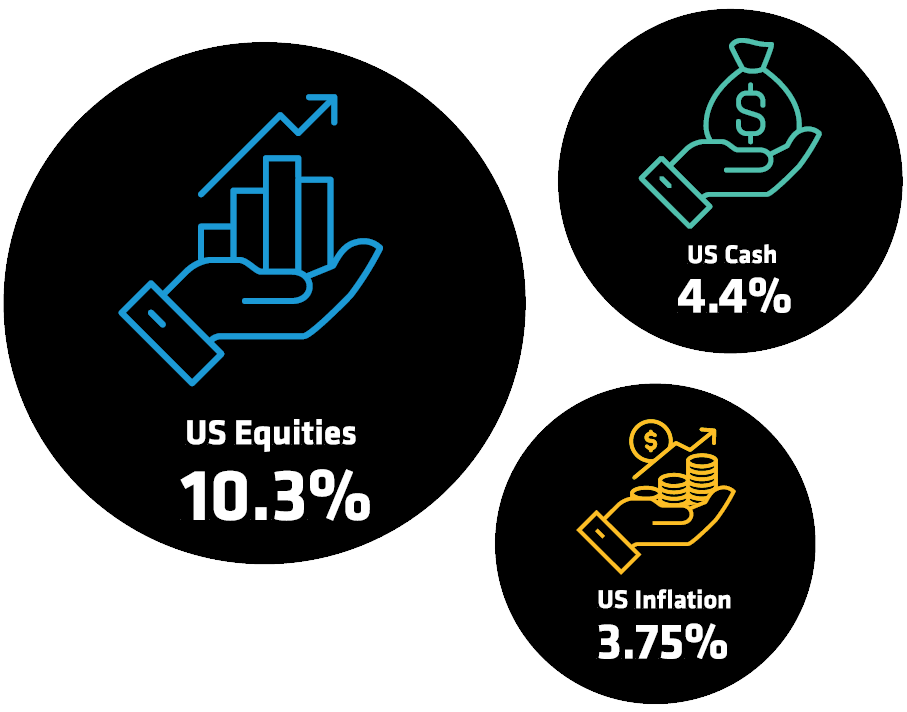

Since the 1960s, US stocks have returned 10.3% annualized versus 4.4% for cash, with inflation at 3.75%. Clearly, equities have been a key pillar for long-term wealth accumulation.

Future equity returns will likely be lower than in recent history, dampened by above-average starting valuations and a much less favorable macro environment. Still, we expect a 7% nominal return globally over the next decade, which would still provide a substantial premium over the historical cash return while outpacing inflation. Cash is likely to deliver a return that’s only similar to inflation.

Corporations themselves are the other major source of demand for equities, via stock buybacks. Over the last decade, firms have been the biggest buyers of US equities, outstripping demand from investors—with no sign of abating. We think this gradual reduction in supply of equities is an extra tailwind.

Current forecasts do not guarantee future results.

Source: AB, as of October 1, 2024

Higher yields aren't here to stay, which will make holding cash less attractive.

The US has started rate cuts with a 50bp cut in September. Rates will likely continue to fall over the next year. This process will likely make holding cash less attractive.

Historical analysis and current forecasts do not guarantee future results.

From 31 January 1960 to 19 September 2024.

Source: Bloomberg (US Equities = MSCI USA Index, US Cash = S&P U.S Treasury Current 3-Month Bill Index, Inflation = US CPI Index).

While cash can have a role in the short term for those worried about high valuations, over the long run investors should consider rebalancing to higher risk assets to put off the greater risk of a loss of purchasing power. Thus, we think equities will remain a key part of portfolios for investors aiming for wealth accumulation.

Market Matters

Delivering timely research-driven insights for navigating dynamic markets.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

This is a marketing communication. This information is provided by AllianceBernstein Limited, 60 London Wall, London, EC2M 5SJ. Registered in England, No. 2551144. AllianceBernstein Limited is authorised and regulated in the UK by the Financial Conduct Authority (FCA - Reference Number 147956). It is provided for informational purposes only and does not constitute investment advice or an invitation to purchase any security or other investment. The views and opinions expressed are based on our internal forecasts and should not be relied upon as an indication of future market performance. The value of investments in any of the Funds can go down as well as up and investors may not get back the full amount invested. Past performance does not guarantee future results. This information is directed at Professional Clients only and is not intended for public use.