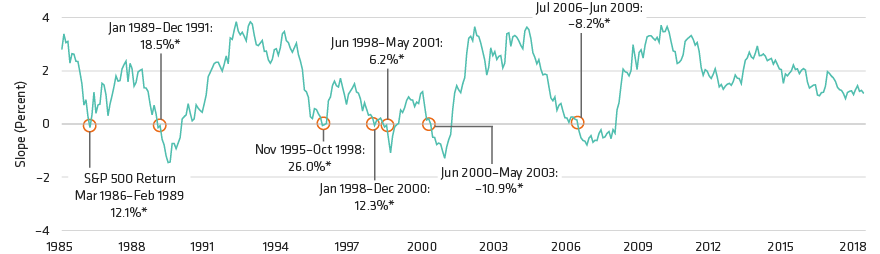

There’s reason to think the yield-curve signal may be distorted this time around. Typically, a flattening curve indicates that monetary policy is too tight. In other words, short-term rates have risen too high for the economy to handle without going into recession.

But adjusted for inflation, the “real” short-term interest rate today is still below 0%. While it’s reasonable to expect rates to peak at much lower levels this cycle than in the past, it doesn’t seem likely that 0% is too much for the economy to handle.

Remember, an inverted yield curve doesn’t cause a recession. It reflects conditions that can trigger one. And if they don’t see those conditions in other places, it’s not unreasonable for policymakers and investors to treat the yield-curve signal with some degree of skepticism.

If Monetary Policy Isn’t to Blame, What Is?

So, if the yield curve isn’t signaling too-tight money, why is it flattening?

We think it’s partly because quantitative easing has distorted the long end of the curve. The Fed’s balance sheet may be shrinking, but it’s still many times its size in past cycles. And the effect of QE programs in other countries has probably boosted demand for US Treasuries, which helps to keep a lid on yields.

What’s more, falling oil prices have helped to temper inflation and growth expectations over the last two months.

What to Expect in 2019

There are plenty of clouds hovering over the outlook for the US and global economies. These include ongoing trade disputes, rising inflation and tighter financial conditions.

But while we expect the pace of US growth to slow next year, we’re not forecasting a recession. On the contrary, we expect a solid 2% growth rate in 2019. Strong hiring puts upward pressure on wages and costs, but it also leads to more consumption, a key engine of the US economy.

In addition, household savings and balance sheets are at their healthiest levels in two decades.

US corporate earnings will probably decelerate in 2019 as the “sugar rush” associated with corporate tax reform starts to fade. The broad reduction in corporate tax rates in 2018 led to an estimated earnings-per-share growth of about 24%. But even with corporate margins possibly peaking, we’re not ready to write off positive earnings growth in 2019.

Of course, with growth slowing and uncertainty rising, markets will remain volatile. But we think the de-risking we’ve seen this year may create some attractive opportunities for active investors.