- The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Time Is Money

Restoring Investor Confidence in Long-Term Cash Flows

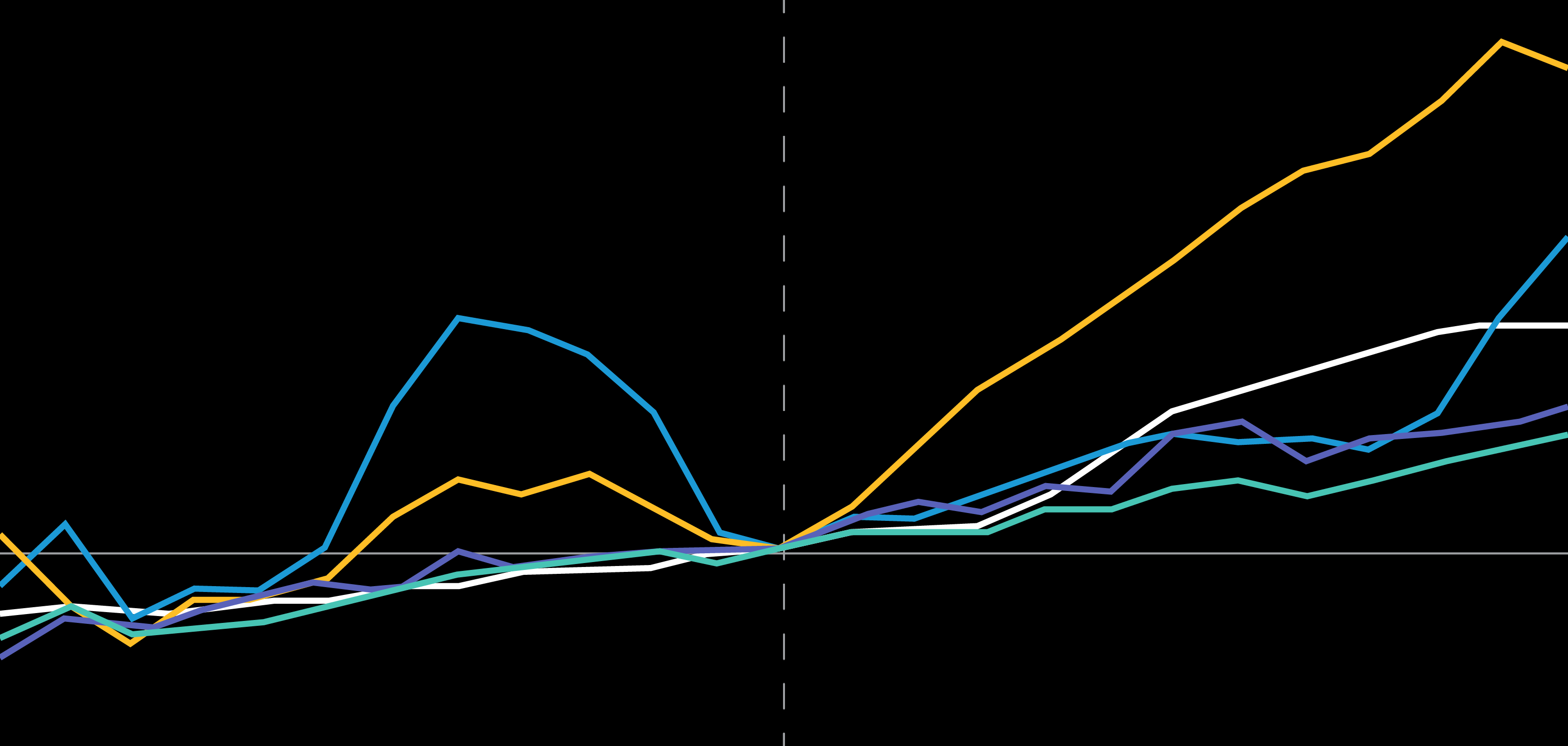

Through August 11, 2021

Source: FactSet, ICE BofA US High Yield Index Effective Yield and AllianceBernstein (AB)

As of July 30, 2021

*Illustrative example. The lower-growth company generates $94 in free cash flow in year 1 and that grows 3% annually thereafter, while the higher-growth company generates $12.50 in free cash flow in year 1, growing 20% thereafter.

†Based on industry components of S&P 1500 Composite Index.

Source: S&P 1500 Composite Index and AllianceBernstein (AB)

Chris Kotowicz joined the firm in 2007 and is a Portfolio Manager and Senior Research Analyst for US Relative Value. He is also a Senior Research Analyst for the US Growth Equities team. As a Senior Research Analyst, Kotowicz is responsible for lead coverage of the industrials, energy and materials sectors. He was previously a sell-side analyst at A.G. Edwards, where he followed the electrical equipment and multi-industry group for four years. Prior to that, Kotowicz worked in the industrial sector, mostly in a technical sales and business development capacity, for Nooter/Eriksen and Nooter Fabricators, each a subsidiary of CIC Group. He holds a BS in civil engineering from the University of Missouri, Columbia, and an MBA (with honors) from the Olin Business School at Washington University. He is a CFA charterholder. Location: Chicago

Vincent Dupont is a Senior Vice President and Director of Research for US Growth Equities. Before joining the US Growth team in 2009 as a portfolio manager, he spent 10 years as a fundamental research analyst covering semiconductors and semiconductor capital equipment. Prior to joining the firm in 1999, Dupont researched the Russian economy at the Council on Foreign Relations for a year and worked at the US State Department as an arms control official for six years. He holds a BA in political science from Northwestern University and a PhD in international affairs/Russian studies from Columbia University, and is a CFA charterholder. Location: New York